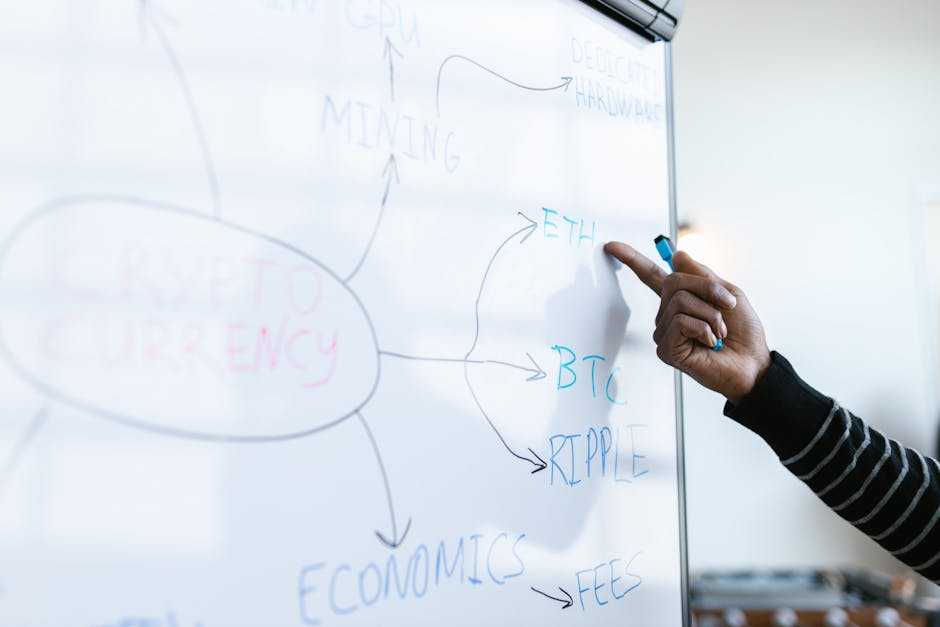

Understanding Crypto and NFT Trends for 2024

In 2024, emerging technologies and evolving regulations are set to reshape the crypto and NFT landscapes further. Staying ahead in this dynamic market requires understanding these two key areas.

Emerging Technologies in Blockchain

- Blockchain innovation continues at a rapid pace.

- Quantum computing poses a potential threat to existing cryptographic methods, prompting developers to explore quantum-resistant algorithms.

- Rollups and sharding improve scalability, enabling faster and cheaper transactions.

- Zero-knowledge proofs (ZKPs) enhance privacy without sacrificing security.

- Decentralized autonomous organizations (DAOs) gain traction, allowing transparent and democratic governance models.

- Cross-chain interoperability becomes essential as projects like Polkadot and Cosmos facilitate seamless data transfer across blockchains.

- Layer 2 solutions, such as Optimistic Rollup and zk-Rollup, offer scalability by processing transactions off the main chain.

Impact of Regulations on Crypto Markets

Regulations significantly influence crypto markets. In 2024, clearer regulatory frameworks from major economies could provide much-needed guidance.

The US and EU are expected to finalize comprehensive legislations that define cryptocurrencies as commodities or securities, impacting trading and taxation.

Decentralized finance (DeFi) platforms may need to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Countries like China have stringent crypto regulations, limiting mining and trading activities, while El Salvador embraces Bitcoin as legal tender, fostering adoption.

Cryptocurrency exchanges face tighter scrutiny, ensuring transparency and consumer protection. Operators might need licenses and must adhere to stricter operational standards, increasing market stability but possibly reducing anonymity.

Key Crypto Trends Anticipated in 2024

Emerging trends in the crypto space in 2024 are set to transform the digital landscape. The section explores innovations in decentralized finance and the ongoing growth of cryptocurrency adoption.

Decentralized Finance (DeFi) Innovations

DeFi continues to push the boundaries of traditional finance with groundbreaking developments. Innovations like Layer 2 solutions, utilizing technologies such as rollups and sharding, drastically enhance transaction speeds and reduce costs.

DeFi protocols are increasingly integrating with traditional financial systems, enabling seamless fiat-to-crypto transfers. Additionally, yield farming, liquidity pools, and staking platforms are evolving to offer more sophisticated financial products, attracting both retail and institutional investors.

Growth of Cryptocurrency Adoption

The adoption of cryptocurrencies is witnessing exponential growth across various sectors. Major retail giants, like Amazon and Walmart, are exploring crypto payment options to cater to the growing consumer demand for digital currencies.

In developing economies, cryptocurrencies provide a hedge against inflation and unstable local currencies, driving mass adoption.

Furthermore, central banks are exploring Central Bank Digital Currencies (CBDCs), with countries like China already piloting digital yuan projects, signaling mainstream acceptance and integration of digital currencies in everyday transactions.

Top NFT Trends to Watch in 2024

The world of NFTs continues to evolve, with 2024 presenting promising developments. I’ll delve into the most significant trends set to shape the NFT landscape.

Evolution of Digital Art and Collectibles

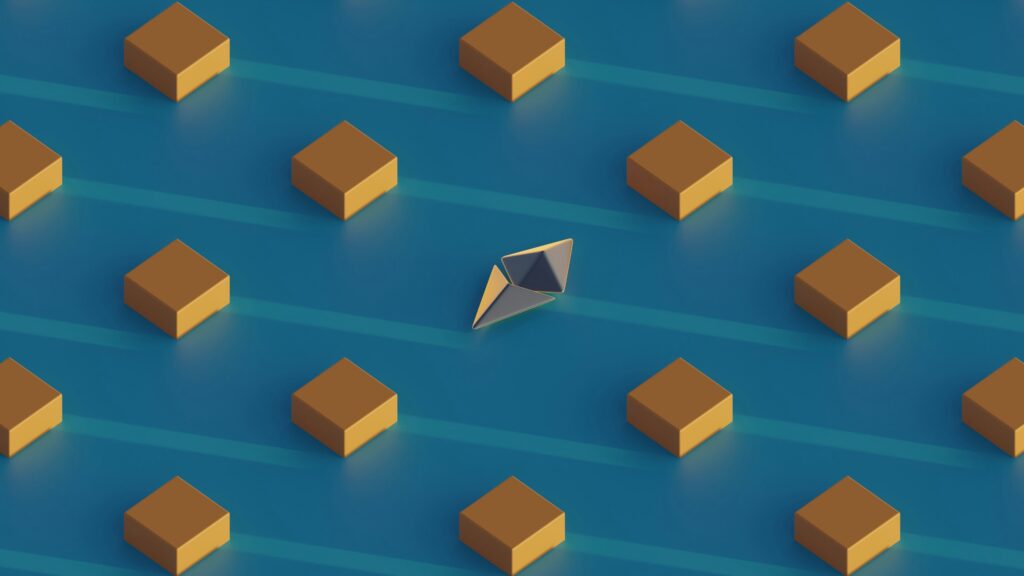

NFTs are revolutionizing digital art and collectibles. Leading artists and creators are leveraging blockchain technology to ensure provenance and authenticity.

The rise of generative art, which uses algorithms to create unique pieces, is gaining traction. Notable platforms like Art Blocks and Async Art highlight this trend, offering collectors exclusive art pieces determined by code.

Additionally, physical and digital interplay is becoming more common. Artists are tokenizing real-world objects, allowing buyers to own both a physical and digital version.

This dual ownership not only enhances the collector’s experience but also broadens the market for traditional artists entering the digital space.

Integration of NFTs in Gaming and Entertainment

The gaming industry is embracing NFTs for asset ownership and in-game economies. Players now have genuine ownership of digital assets, ranging from characters to virtual real estate.

Games like “Axie Infinity” and “The Sandbox” are popular examples where NFTs enable players to trade, sell, and monetize in-game items.

Entertainment giants are also tapping into NFTs to enhance fan engagement. Musicians, for instance, are creating limited edition digital merchandise and exclusive concert tickets as NFTs.

Companies like Ubisoft and Warner Music Group are spearheading initiatives to integrate NFTs within their ecosystems, providing new revenue streams and fan interaction opportunities.

Investment Perspective

Investing in crypto and NFTs in 2024 offers dynamic opportunities. Emerging trends, technological advancements, and market predictions shape the investment landscape.

Navigating Crypto and NFT Investments

Understanding how to navigate crypto and NFT investments in 2024 requires knowledge of evolving market conditions. Investors should diversify their portfolios to mitigate risks.

For example, mixing stablecoins, like USDT and USDC, with volatile assets such as Bitcoin and Ethereum can balance risk and reward.

Security remains paramount; using hardware wallets and enabling 2-factor authentication protects assets. Keeping abreast of legal developments, particularly those involving tax implications and regulatory compliance, allows investors to make informed decisions.

Predictions for Market Performances

Market performance predictions for 2024 focus on several key factors. Analysts suggest that Bitcoin might reach new highs if institutional adoption increases.

NFT markets could see explosive growth, especially in sectors like:

- gaming

- virtual real estate

Ethereum, with its transition to Ethereum 2.0, promises enhanced scalability and reduced gas fees, which could attract more developers and investors.

Regulatory clarity in major economies may also stabilize markets, encouraging more mainstream adoption and investment inflows.