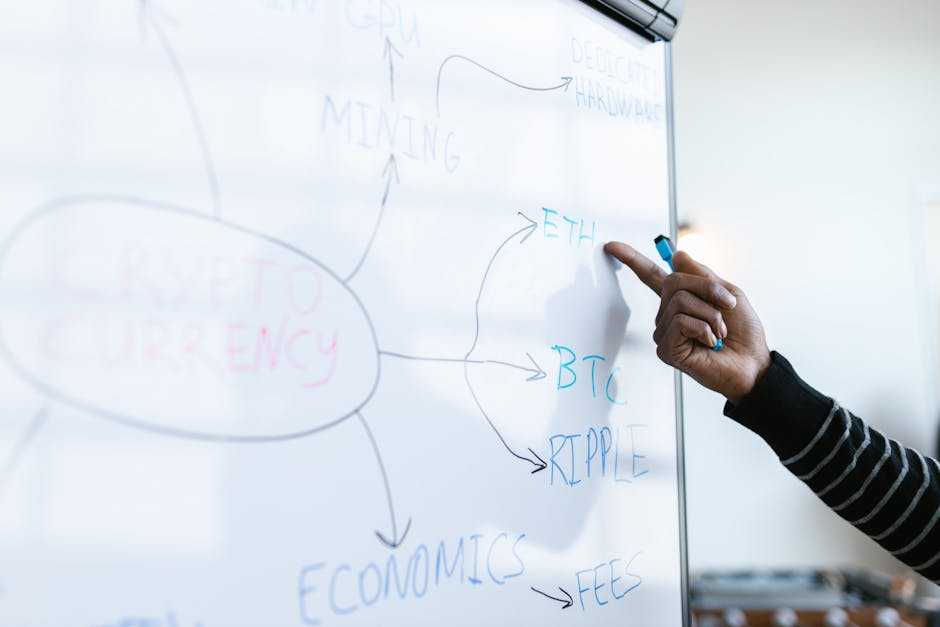

The Emergence of NFTs in the Cryptocurrency Landscape

NFTs have carved a unique niche within the cryptocurrency ecosystem. They’ve shifted perceptions of digital ownership and value creation.

What Are NFTs?

NFTs, or Non-Fungible Tokens, are digital assets representing ownership of unique items, such as artwork, music, or virtual real estate. Unlike cryptocurrencies like:

- Bitcoin

- Ethereum

which are fungible and exchangeable on a one-to-one basis, NFTs are indivisible and irreplaceable. Each NFT possesses distinct metadata and ownership records stored on blockchain technology, ensuring transparency and security.

A Brief History of NFTs

The concept of NFTs traces back to the launch of colored coins on the Bitcoin blockchain in 2012. However, the Ethereum blockchain’s introduction of the ERC-721 standard in 2017 marked the true beginning of NFTs as we know them.

CryptoKitties, a blockchain-based game allowing users to breed and trade unique digital cats, quickly became a cultural phenomenon later that year, highlighting the potential of NFTs in popular culture.

Since then, various platforms and artists have embraced NFTs, propelling them into the mainstream crypto landscape.

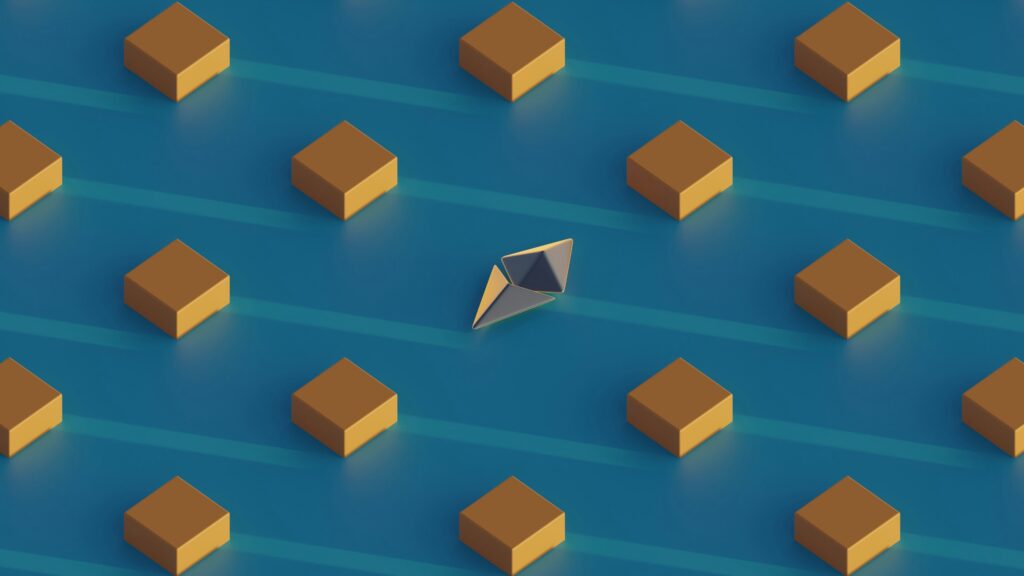

Key Features of NFTs

NFTs incorporate key features that redefine digital ownership. These features add unique value and form the essence of what makes NFTs fascinating and transformative.

Ownership and Provenance

NFTs ensure clear ownership and provenance, aspects that drastically enhance their value proposition. Blockchain records every transaction related to an NFT, creating an unalterable history.

Buyers and sellers trust these records for their accuracy and transparency. For example, an artist can prove the authenticity of digital artwork using the embedded metadata within the NFT.

Scarcity and Exclusivity

NFTs introduce scarcity and exclusivity into the digital asset realm. Only a limited number of NFTs can be created for a particular digital item, making each one unique or part of a rare collection.

This scarcity often drives up value, similar to rare physical collectibles. For instance, renowned collections like CryptoPunks owe much of their high value to their limited number and exclusive ownership records.

The Impact of NFTs on the Cryptocurrency Market

NFTs have profoundly influenced the cryptocurrency market, driving both technological adoption and financial dynamics.

Increase in Blockchain Adoption

NFTs have significantly boosted blockchain adoption. Their rise has promoted awareness about the blockchain’s capabilities beyond cryptocurrency.

Ethereum remains the primary blockchain for NFTs, leveraging its ERC-721 and ERC-1155 standards to create and trade them. Other blockchains like Binance Smart Chain and Flow have also emerged to compete.

These systems enhance the scalability and lower transaction fees, making NFTs accessible to broader audiences.

Financial Implications and Market Dynamics

NFTs have introduced new financial dynamics into the cryptocurrency market. They enable fractional ownership, allowing investors to own a percentage of high-value NFTs.

This democratizes investment opportunities, attracting a more diverse investor base. In 2021, NFT transactions exceeded $23 billion, showcasing their market impact.

The scarcity and exclusivity of NFTs drive value, akin to rare collectibles. They also foster secondary markets, where NFTs can be bought and sold at fluctuating prices, introducing volatility and liquidity into the cryptocurrency market.

Future Prospects of NFTs in Cryptocurrency

NFTs continue to evolve, paving new paths in the cryptocurrency ecosystem. Innovative advancements and long-term market predictions showcase their growing influence.

Innovations and Technological Advancements

- Emerging technologies are expanding NFT applications.

- Ethereum’s ERC-721 standard, which debuted in 2017, set the stage for numerous advancements.

- Layer-2 scaling solutions like Polygon improve transaction speeds and lower costs, making NFTs more accessible.

- Cross-chain interoperability also gains traction, allowing NFTs to move between different blockchains, enhancing liquidity and functionality.

- Integrating artificial intelligence and virtual reality creates immersive NFT experiences. AI-generated art, for example, offers unique, one-of-a-kind digital pieces.

Long-Term Predictions for NFT Markets

Long-term, NFTs may redefine digital asset ownership. Analysts predict the NFT market could exceed $80 billion by 2025 based on growing adoption across various sectors.

Gaming, for example, incorporates NFTs for in-game assets, aligning with the metaverse’s expansion. The real estate industry explores virtual property sales through NFTs, offering new investment avenues.

Moreover, NFT adoption in intellectual property rights could streamline licensing and royalties, reducing fraud. Reduced market volatility and increased regulatory clarity may further stabilize this market, attracting institutional investors and ensuring sustainable growth.

Challenges and Criticisms of NFTs

Non-Fungible Tokens (NFTs) present several challenges that have sparked criticism and concern, impacting their acceptance and growth in the cryptocurrency world.

Environmental Concerns

The significant energy consumption of blockchain networks, particularly Ethereum’s proof-of-work mechanism, has raised environmental concerns.

The creation, sale, and trading of NFTs involve numerous transactions, each requiring substantial computational power. This energy intensity contributes to a larger carbon footprint, drawing criticism from environmentalists and raising questions about sustainability.

Initiatives like Ethereum’s transition to proof-of-stake and the development of more eco-friendly blockchains seek to mitigate these environmental impacts.

Market Volatility and Security Issues

NFTs’ market price volatility adds another layer of complexity. Despite the growing market, NFT values can fluctuate wildly due to speculative trading, resulting in potential financial losses for investors.

Moreover, security concerns, such as smart contract vulnerabilities and the risk of digital theft, pose significant risks. Instances of stolen digital art and phishing attacks highlight the need for stronger security measures and regulatory frameworks.

Improved technology and enhanced regulatory oversight could address these issues over time, but they remain pressing challenges for NFT adoption today.