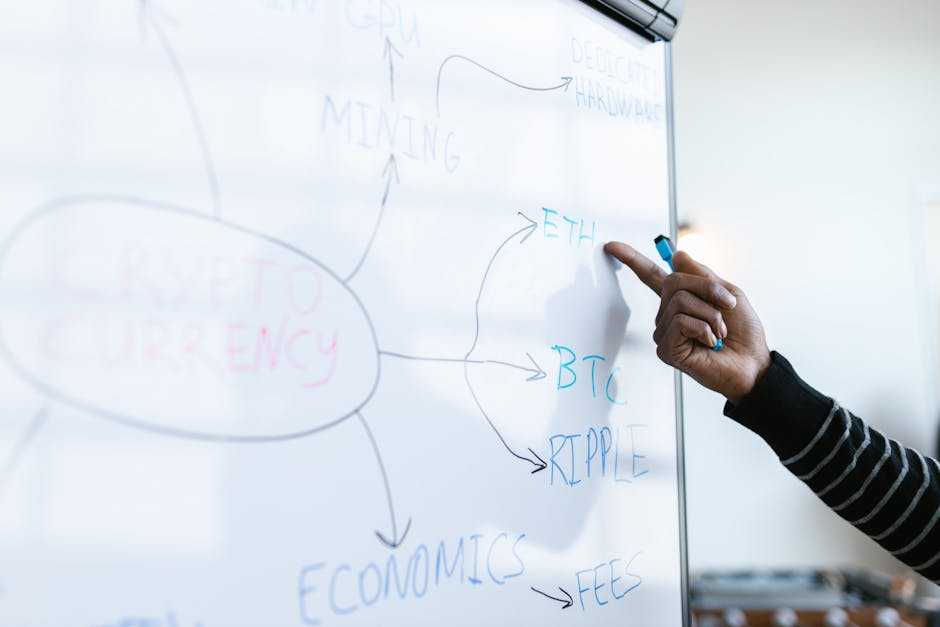

Current State of the Crypto Market

As of 2023, the crypto market has demonstrated significant volatility yet remains a focal point for investors.

Overview of Market Trends

Several trends have emerged in the crypto market. DeFi (Decentralized Finance) platforms are seeing increased adoption, showing roughly a 300% year-on-year growth.

New regulations are influencing digital currency transactions, with countries like the USA and India implementing stricter guidelines. Stablecoins, exemplified by USDT and USDC, are gaining popularity for their lower volatility.

Blockchain-based gaming, represented by projects like Axie Infinity, continues to attract users.

Major Cryptocurrencies and Their Performance

Bitcoin (BTC) maintains its status as the leading cryptocurrency, with a market cap exceeding $500 billion. Ethereum (ETH) follows closely, benefiting from the rise of DeFi and NFTs, boasting a $200 billion market cap.

Binance Coin (BNB), used primarily on the Binance exchange, has a market cap near $80 billion. Other significant players include Cardano (ADA) and Solana (SOL), each contributing innovatively to the blockchain ecosystem.

Current State of the NFT Market

NFTs, or non-fungible tokens, have seen explosive growth in recent years. The market now caters to a diverse range of industries and investors.

Popularity and Use Cases of NFTs

NFTs have gained popularity due to their unique digital ownership model. These tokens have various use cases such as:

- Art and Collectibles: Artists like Beeple have sold digital artworks for millions. Online platforms like OpenSea and Rarible facilitate these transactions.

- Gaming: Games like Axie Infinity and Decentraland allow players to buy, sell, and trade in-game assets as NFTs.

- Music and Entertainment: Musicians like Kings of Leon and artists like Grimes release music NFTs which provide unique fan experiences.

- Real Estate: Virtual real estate in platforms like Decentraland lets users invest in and develop digital property.

Significant NFT Sales and Auctions

High-profile NFT sales showcase the market’s immense financial potential such as:

- Beeple’s “Everydays: The First 5000 Days”: Sold for $69.3 million at Christie’s auction.

- CryptoPunk #7804: Bought for 4200 ETH (approximately $7.6 million at the time).

- Jack Dorsey’s First Tweet: The Twitter founder’s tweet sold as an NFT for $2.9 million.

- Bored Ape Yacht Club (BAYC): These NFTs frequently fetch prices in the millions, with notable sales often crossing the $1 million mark.

These sales highlight investor interest and the substantial value placed on digital assets. The NFT market’s evolution continues, reflecting broader trends in digital ownership and blockchain technology.

Challenges Facing the Crypto and NFT Markets

The crypto and NFT markets face several challenges, impacting their growth and stability. These issues range from regulatory hurdles to inherent market volatility.

Regulatory Challenges

Regulatory challenges in the crypto and NFT markets are significant.

Governments worldwide seek to regulate these decentralized technologies, creating uncertainty for investors. In the U.S., the SEC treats some cryptocurrencies like securities, subjecting them to stringent regulations.

The EU’s Markets in Crypto-assets (MiCA) regulation aims to create a framework for digital assets, affecting market operations. In Asia, countries like China have banned crypto trading, while Japan implements strict licensing procedures.

Regulatory ambiguity hampers market growth and deters institutional investment.

Market Volatility and Security Concerns

Market volatility remains a major concern in crypto and NFT markets. Cryptocurrencies experience drastic fluctuations; for instance, Bitcoin’s value dropped from nearly $64,000 in April 2021 to around $29,000 by June 2021. Such volatility impacts investor confidence and market stability.

Additionally, security concerns like hacking and fraud pose serious risks. High-profile hacks, including the $600 million Poly Network attack, expose vulnerabilities.

NFTs aren’t immune either; cases of counterfeit NFTs and intellectual property theft have surfaced. Addressing these security challenges is essential for market trust.

Future Predictions for Crypto and NFTs

Cryptocurrencies and NFTs will likely see significant developments in the upcoming years as these markets evolve. Forecasts suggest a mix of innovations, growth, and new risks.

Innovations on the Horizon

Blockchain technologies will continue to advance, leading to more efficient and scalable solutions. Layer 2 solutions, for instance, could enhance transaction speeds and reduce costs. Interoperability between different blockchain networks may also improve, enabling seamless asset transfers.

Decentralized finance (DeFi) will likely offer more sophisticated financial products. Flash loans, synthetic assets, and decentralized exchanges are some examples. Expect new platforms that can better integrate with traditional financial systems.

NFTs may expand beyond the arts and collectibles sector. Use cases could include real estate tokenization, digital identity verification, and supply chain logistics. These applications can leverage blockchain’s transparency and immutability.

Potential Market Growth and Risks

Crypto market capitalization might surpass trillions of dollars. More institutional investors are entering the space, which could drive mainstream adoption. Countries may launch or pilot their own central bank digital currencies (CBDCs).

However, risks will persist. Regulatory scrutiny could intensify, creating compliance challenges for crypto businesses. Cybersecurity threats, like hacking and phishing, will remain a concern. Malicious actors will find new ways to exploit vulnerabilities in these systems.

Market volatility continues to be a critical issue. Crypto prices can swing dramatically, impacting investor sentiment and financial stability. Measures to stabilize the market and protect investors’ interests must evolve to support sustainable growth.

Maintaining a balance between innovation and risk management will define the future trajectory of the crypto and NFT markets.