Understanding NFTs and Cryptocurrencies

NFTs and cryptocurrencies revolutionize the financial landscape with unique technological frameworks.

What Are NFTs?

NFTs (non-fungible tokens) represent unique digital assets on blockchain networks. Unlike cryptocurrencies like Bitcoin, each NFT is distinct, offering exclusive ownership and authenticity proof.

They can embody art, music, collectibles, and virtual real estate. For example, CryptoPunks and Bored Ape Yacht Club are prominent NFT collections, often fetching high prices. NFTs offer creators new revenue streams through royalties and decentralized transactions.

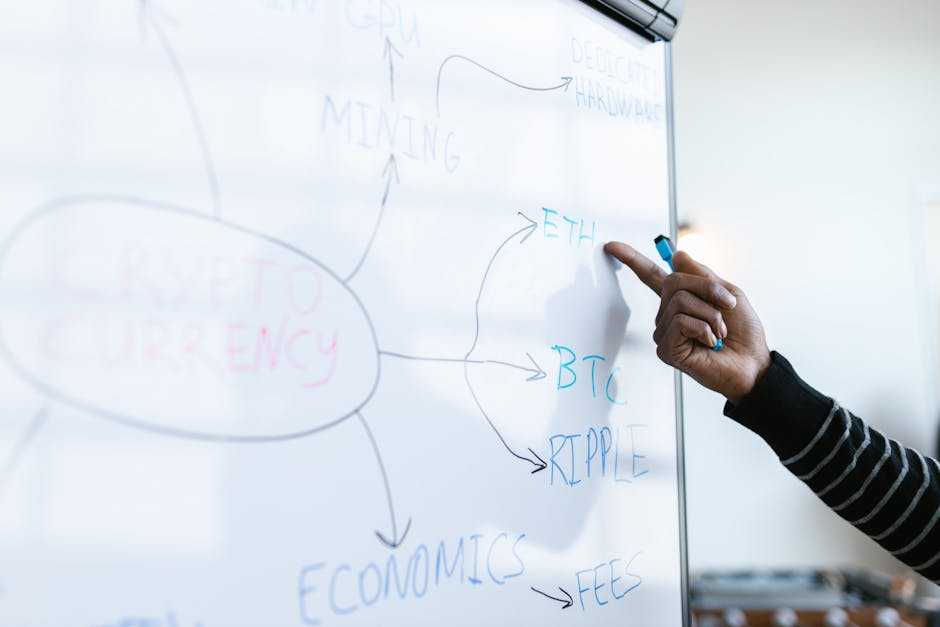

How Do Cryptocurrencies Work?

- Cryptocurrencies function as digital or virtual currencies secured by cryptography.

- Operating on decentralized networks like blockchain technology, they enable peer-to-peer transactions without intermediaries.

- Bitcoin and Ethereum are primary examples, where blockchain ensures transparency and security.

- Cryptocurrencies also rely on consensus mechanisms, like proof-of-work or proof-of-stake, to validate transactions and maintain network integrity.

- Their value fluctuates based on demand, utility, and market dynamics.

The Relationship Between NFTs and Cryptocurrency Prices

NFTs, digital assets on the blockchain, significantly impact cryptocurrency prices. Both sectors are interconnected, and shifts in one often influence the other.

Influence of NFT Trading on Crypto Markets

NFT trading volumes can drive demand for related cryptocurrencies. When NFT sales surge, the demand for transaction-fee cryptocurrency like Ethereum increases.

For example, heightened activity on platforms like OpenSea results in higher Ethereum usage, impacting ETH prices. Moreover, investor sentiment shifts when notable NFT projects gain popularity, causing broader movements in the crypto market.

Case Studies: Significant NFT Sales and Crypto Responses

Several notable NFT sales have noticeably affected cryptocurrency prices. In March 2021, Beeple’s “Everydays: The First 5000 Days” sold for $69.3 million, causing a spike in Ethereum activity.

ETH prices climbed by 25% due to increased attention and transaction volumes. Similarly, the sale of CryptoPunk #7523 for $11.8 million in June 2021 generated considerable interest, driving up both Ethereum usage and its price.

These cases illustrate the direct impact of major NFT sales on the cryptocurrency ecosystem.

Economic Implications of NFTs on Cryptocurrency

NFTs impact cryptocurrency prices through various economic mechanisms. Their unique attributes and market dynamics create substantial effects on the broader crypto ecosystem.

Market Volatility and Investor Behavior

NFT markets exhibit significant volatility, causing fluctuations in cryptocurrency prices. Major NFT sales often lead to increased activity on blockchain networks like Ethereum, influencing its price.

For instance, high-profile transactions, such as Beeple’s “Everydays: The First 5000 Days” sale, attracted significant investor attention and activity, driving up Ethereum’s value.

Investors react quickly to NFT trends, leading to rapid price changes in associated cryptocurrencies. Sudden increases in NFT demand can deplete cryptocurrency reserves, while sharp drops can lead to sell-offs.

Regulatory Challenges and Market Stability

Regulatory issues surrounding NFTs affect cryptocurrency market stability. Governments and financial bodies scrutinize NFT transactions to address concerns over money laundering and fraud.

Regulatory actions can disrupt the NFT market, leading to instability in related cryptocurrencies.

For example, if a country imposes stringent regulations on NFT marketplaces, it could reduce transaction volumes, affecting the demand for cryptocurrencies used in those platforms.

Conversely, clear and supportive regulations can stabilize the market, fostering investor confidence and maintaining consistent demand for cryptocurrencies.

Future Trends in NFTs and Cryptocurrency Prices

As NFTs evolve, their impact on cryptocurrency prices will likely continue to grow. Emerging such as:

- technologies

- market maturity

- regulatory

changes all play roles.

Predictions and Emerging Patterns

Experts predict that the NFT market will diversify beyond art into real estate, gaming, and intellectual property. As NFTs spread across various sectors, cryptocurrency prices, especially Ethereum, are expected to see increased volatility.

For example, the integration of NFTs in gaming can lead to significant spikes in token use within those platforms.

More sophisticated blockchain technology could also drive stablecoin usage for NFT transactions. These trends suggest that the correlation between NFT market activity and cryptocurrency prices will become more intricate.

For instance, an increase in gaming NFTs might encourage broader adoption of specific cryptocurrencies.

Regulatory environments are another factor. Stricter regulations in major markets might push NFT transactions to more crypto-friendly regions, impacting the global demand for cryptocurrencies.

The shifts in transaction volumes due to regulatory changes could influence price stability and market confidence.

Overall, observing how these patterns develop will be crucial for predicting future cryptocurrency price movements connected to NFT activity.