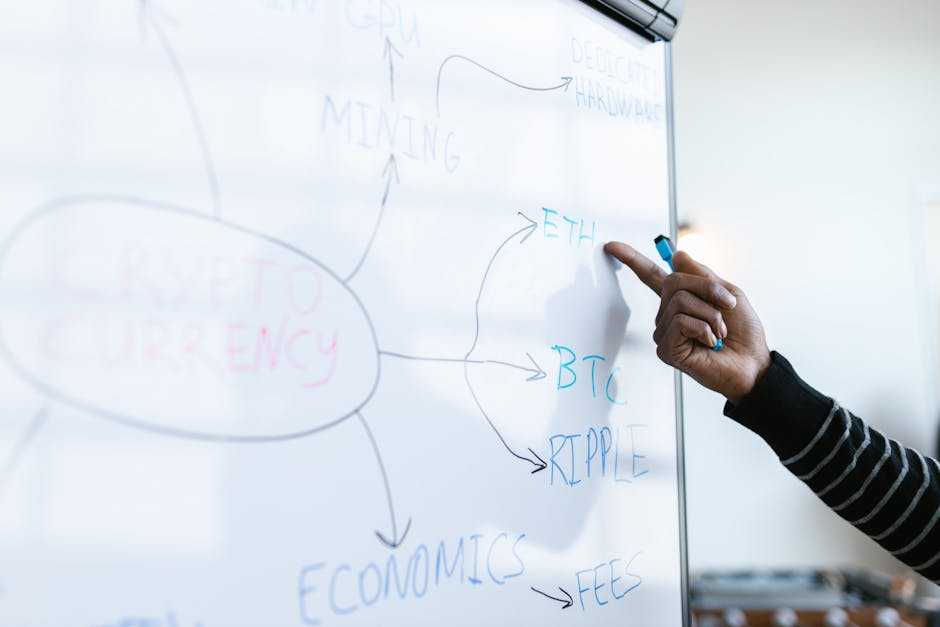

Overview of Major Trends in Crypto and NFT Adoption

Cryptocurrencies and NFTs are transforming finance and ownership. Bitcoin’s surge and the rise of digital art on blockchain have set the stage for broader acceptance. Several major trends illustrate this evolving landscape.

Institutional Investment

Large financial institutions are investing in cryptocurrencies. Goldman Sachs and Morgan Stanley, for example, are offering Bitcoin funds to clients. This trend enhances market credibility and attracts more investors.

Mainstream Adoption

Major companies are embracing cryptocurrencies. Tesla, for instance, accepts Bitcoin for payments, and PayPal allows cryptocurrency transactions. These developments bring digital currencies into everyday use.

Regulatory Evolution

Governments are crafting regulations for cryptocurrencies. The US, China, and the EU are introducing frameworks to manage digital assets. These regulations aim to protect investors while fostering innovation.

NFT Market Expansion

NFTs are gaining popularity beyond digital art. Gaming, music, and virtual real estate sectors are embracing NFTs. Platforms like OpenSea and Rarible are leading this expansion, making NFTs more accessible.

Environmental Concerns

Crypto mining’s high energy consumption is raising environmental concerns. Bitcoin mining activities, especially, are under scrutiny. Initiatives are emerging to create eco-friendly blockchain technologies.

Technological Innovations

Innovations are enhancing blockchain efficiency. Ethereum 2.0, for example, aims to improve scalability and reduce energy consumption. These technological advancements support broader adoption.

Rising Demand for Security

As crypto and NFT valuations grow, so does the demand for security. Custodial services and hardware wallets, like Ledger and Trezor, are becoming essential for protecting digital assets.

Decentralization in Finance and Art

Decentralization in both the financial and art sectors is transforming traditional systems. The decentralized approach provides more autonomy, transparency, and innovation.

Rise of Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, leverages blockchain technology for financial transactions, removing intermediaries like banks. Popular DeFi platforms include Uniswap, Aave, and Compound.

According to DeFi Pulse, as of October 2023, the total value locked (TVL) in DeFi protocols exceeds $80 billion. DeFi applications support lending, borrowing, and trading without central control. Users can earn high yields from staking and liquidity providing.

Smart contracts automate transactions, ensuring they execute transparently and securely. For example, users can lend crypto assets on Aave and earn interest, all without involving a traditional bank.

Impact on the Art Industry Through NFTs

NFTs revolutionize the art industry by enabling digital ownership and provenance on the blockchain. Artists mint digital artwork as NFTs, which verify authenticity and ownership.

Platforms like OpenSea and Rarible facilitate these transactions. Notable examples include Beeple’s artwork “Everydays: The First 5000 Days”, which sold for $69.3 million at Christie’s in 2021.

NFTs also benefit artists with royalties from secondary sales. Digital art isn’t the only focus; music, video clips, and virtual real estate see rising NFT adoption. Musicians can tokenize songs and distribute them directly, maximizing revenue and control.

For instance, Kings of Leon released their album “When You See Yourself” as an NFT, generating over $2 million in sales.

Regulatory and Legal Landscape

The regulatory and legal landscape for crypto and NFTs evolves rapidly. Authorities worldwide work to create frameworks that ensure security without stifling innovation.

Global Regulatory Responses

Governments and regulatory bodies respond differently to the rise of crypto and NFTs. In the US, the Securities and Exchange Commission (SEC) scrutinizes Initial Coin Offerings (ICOs) to categorize them as securities. The Commodity Futures Trading Commission (CFTC) considers Bitcoin a commodity. The European Union implements the Markets in Crypto-Assets (MiCA) regulation to standardize rules. In China, a crackdown on crypto trading and mining reflects the government’s stance.

| Country/Region | Regulatory Body | Regulation | Key Actions |

|---|---|---|---|

| US | SEC, CFTC | Securities law, Commodity law | ICO scrutiny, Commodity classification |

| EU | ESMA | MiCA | Standardizing crypto regulations |

| China | PBOC | Crypto ban | Prohibiting trading and mining |

Legal Considerations and Compliance

Legal considerations intersect with compliance requirements. Anti-Money Laundering (AML) and Know Your Customer (KYC) laws demand robust identity verification.

Tax regulations in multiple jurisdictions require reporting crypto gains. Intellectual property laws protect digital art’s originality in NFTs. Compliance with General Data Protection Regulation (GDPR) ensures data privacy in handling user information.

Countries mandate adherence to these laws, enabling a secure, transparent environment for crypto and NFT transactions. Security measures, such as custodial services, mitigate risks, while legal clarity boosts user confidence.

Technological Advancements and Security

Technological advancements drive adoption in both cryptocurrency and NFTs. Enhanced security frameworks safeguard these digital assets.

Blockchain Innovations

Blockchain innovations contribute to more efficient and secure transactions. Layer 2 solutions, like the Lightning Network for Bitcoin, increase transaction speeds while minimizing costs.

Smart contracts on platforms like Ethereum, Cardano, and Solana automate transactions and reduce the need for intermediaries, adding an extra layer of security and transparency.

Improvements in Security Measures

Security measures are evolving to protect digital assets. Multi-signature wallets require multiple approvals before transactions proceed, reducing risks of unauthorized transfers.

wallets, such as Ledger and Trezor, offer offline storage solutions, making it harder for hackers to access funds. Advanced encryption standards ensure the safety and integrity of transactions, providing users with greater confidence in their digital holdings.

Market Expansion and Consumer Adoption

Cryptocurrencies and NFTs are no longer niche interests. Their market expansion and consumer adoption are skyrocketing, driven by innovative use cases and broader acceptance.

Increase in Mainstream Acceptance

Mainstream acceptance of cryptocurrencies and NFTs is accelerating. Major corporations, such as Tesla and PayPal, now accept Bitcoin for transactions.

NFT adoption is soaring, with platforms like OpenSea exceeding $3.4 billion in monthly trading volume. Celebrities, such as Snoop Dogg and Paris Hilton, create and sell NFTs, indicating growing consumer interest.

Sports leagues like the NBA also tap into NFTs with projects like NBA Top Shot. This involvement boosts consumer confidence and drives broader market participation.

Challenges and Opportunities for New Users

- New users face challenges when entering the crypto and NFT markets.

- They often grapple with understanding blockchain technology and digital wallets. Security concerns also deter newcomers.

- Opportunities abound. Tools and resources for beginners are expanding, with platforms like Coinbase offering user-friendly interfaces and educational materials.

- Investment in crypto is increasingly seen as a hedge against inflation, providing financial growth opportunities. NFTs offer new revenue streams in digital art and collectible markets.

- Enhanced security measures, like multi-signature wallets, also improve user confidence and adoption.