What Volatility Really Means in Digital Assets

In simple terms, volatility measures how much and how fast an asset’s price moves over time. In the context of crypto and NFTs, volatility tends to be extreme. Prices can swing wildly within hours or even minutes. One tweet, a rumor, or a hack can send values into double digit spikes or nose dives. That kind of instability is the norm in Web3, not the exception.

Compare that to traditional markets stocks, bonds, commodities. They’re regulated. Oversight bodies monitor insider trading, enforce transparency, and attempt to buffer the entire system from chaos. Plus, most investors anchor decisions to fundamental indicators like revenue, earnings, or GDP shifts. In crypto and NFTs, those anchors are looser or nonexistent. You’re dealing with experimental tech, emerging networks, and sentiment driven behavior.

This is why sudden swings are baked into the DNA of Web3 ecosystems. Few established benchmarks. Modest barriers to entry. Constant innovation and just as many rug pulls. Combine that with global participation and trading bots running 24/7, and you’re looking at markets that never sleep and rarely hold still. Anyone working or investing in this space needs to understand that volatility isn’t a bug of the system. It’s one of the features.

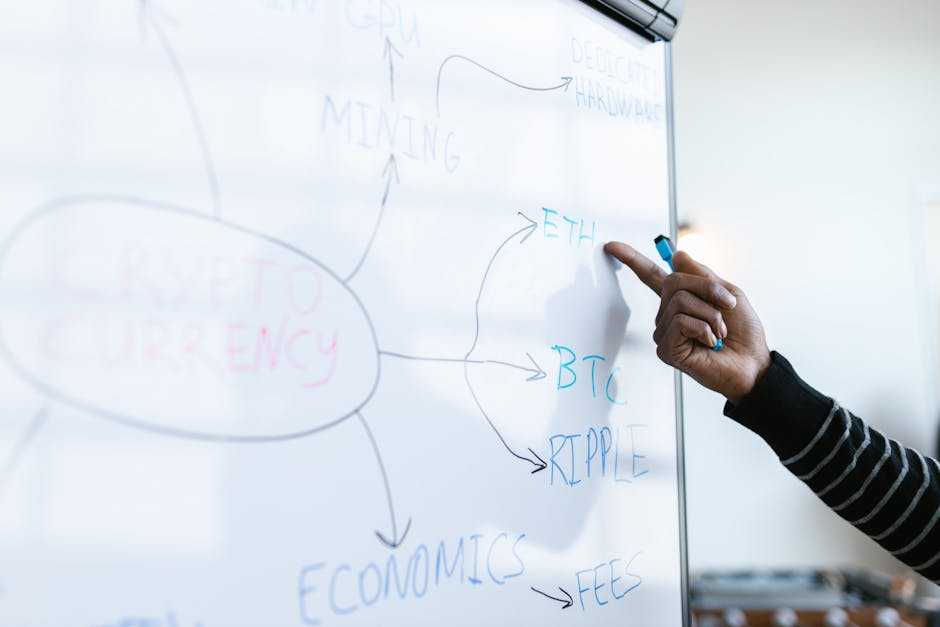

Crypto Volatility: Forces at Play

Volatility in the crypto market is not random it’s the result of a variety of interconnected forces. From tokenomics design to global economic headlines, there’s a constant tug of war shaping prices, sentiment, and behavior.

The Core Dynamics: Supply, Demand & Scarcity

Unlike traditional markets, many cryptocurrencies are built on enforced scarcity.

Limited Supply: Many crypto assets have fixed supply caps, making them susceptible to sharp swings as demand shifts.

High Demand Sensitivity: Social media influence, fear of missing out (FOMO), and trend based buying often generate dramatic price movements in short timeframes.

Tokenomics Design: How a coin is structured including things like burn rates, distribution models, or staking incentives can amplify market moves.

Speculation, Hype Cycles, and Whale Activity

Beyond fundamentals, volatility thrives where speculation and emotion meet.

Hype Driven Investment: Viral tweets, influencer mentions, and project launches can spark instant surges, often followed by equally dramatic dips.

Whale Movements: Large holders (“whales”) can significantly shift markets by buying or selling in volume. Their trades are closely watched and often imitated, which fuels further volatility.

Pump and Dump Risks: Despite efforts at regulation, coordinated pump and dump schemes still pose risks, especially for newer tokens and low volume coins.

The Bigger Picture: Macroeconomic Triggers

While crypto is often viewed as decentralized and independent, it is far from immune to global financial factors.

Interest Rates: Central bank decisions can influence liquidity across all markets, including digital ones.

Regulatory Shifts: Announcements of government crackdowns or legal clarifications often spark immediate reactions.

Global Events: Political unrest, financial crises, or even tech disruptions can echo throughout the crypto landscape.

Explore More

To dive deeper into the economics behind crypto market shifts, check out this extended guide:

Understanding Market Volatility in Crypto and NFTs: Essential Insights for Investors

How NFT Markets Respond Differently

NFT markets don’t follow the same rules as traditional assets and that’s both their magic and their mess. At the core of it: illiquidity and pricing subjectivity. Unlike crypto tokens, which can be quickly bought or sold on high volume exchanges, NFTs often move sluggishly. You can list a piece for sale, sure, but whether someone bites is another story entirely. Even with hot collections, volume can dry up fast.

Then there’s pricing. NFTs live in the realm of perceived value. The same digital collectible might sell for $200 one day, and $2,000 the next without much logical rationale. This isn’t just about rarity traits or utility. It comes down to culture, story, timing, and who’s talking about it.

Creator reputation often outshines project fundamentals. If a well followed artist or influencer drops a collection, buyers pile in regardless of long term vision. This leads to inflated floors based more on social momentum than execution. Meanwhile, quieter projects with solid tech or community roadmaps often get overlooked.

And sometimes an entire project can skyrocket just because a few whales decide to sweep the floor. That’s the thing with community driven buying frenzies they create sharp spikes with little warning. It’s hype meets herd mentality. Great when you’re in early, painful if you’re the exit liquidity.

Understanding this isn’t about becoming cynical. It’s about navigating an emotional market with clear eyes. Not every pump is signal. Not every dip is doom. But almost every move tells a story and that’s worth paying attention to.

Tools to Track and Manage Swings

Volatility in crypto and NFT markets can feel unpredictable, but with the right tools and strategies, investors can better understand and respond to price swings. Here are key approaches to tracking and managing volatility effectively.

Volatility Indexes: Measuring the Mood

Crypto markets lack a single, universal volatility index like the VIX in traditional finance, but several platforms offer metrics to help gauge risk:

Crypto Volatility Index (CVI): A decentralized alternative that reflects fear and uncertainty across major assets

Implied volatility charts for BTC, ETH, and altcoins offered on select trading platforms

On chain data indicators that signal potential turbulence (e.g., rising exchange inflows, whale wallet movement)

These tools can be useful for spotting market sentiment shifts before they impact prices.

Smart Portfolio Allocation Strategies

Managing risk isn’t about eliminating volatility it’s about positioning for it intentionally. Diversified, well balanced portfolios can reduce overall exposure to adverse swings.

Allocating across market caps: Include a mix of large cap (BTC, ETH), mid cap, and niche tokens

Rebalancing regularly: Helps lock in gains and maintain target risk levels

Holding a stablecoin buffer: Maintains flexibility for buying dips or reallocating quickly

Tech Savvy Risk Management

High functioning wallets and analytics platforms open up smarter decision making. Here’s what savvy investors are using:

Non custodial wallets with integrated analytics (e.g., MetaMask + DappRadar or Rabby with built in asset tracking)

Customizable alerts from tools like CoinMarketCap, TradingView, or DeFiLlama for real time insights

Portfolio dashboards like Zapper, DegenScore, or ApeBoard to track multi chain holdings and performance

Choosing the right stack of tools doesn’t eliminate risk but it provides a clearer picture when volatility strikes.

For a deeper look into managing crypto and NFT volatility, check out the full article: crypto volatility insights

Staying Grounded in a Rollercoaster Market

Volatility isn’t just a chart pattern it’s a mental test. In crypto and NFTs, things move fast, often irrationally. Prices spike on rumors and crash on silence. The ones who survive aren’t the ones who move fastest. It’s the ones who can sit still when everything screams move.

Emotional discipline is non negotiable. That means not buying into the hype train just because everyone else is boarding, and not panic selling when the floor drops out. Staying grounded means zooming out. If your strategy only works during bull runs, it isn’t a strategy it’s a bet.

Long term conviction in your investments beats playing hot potato with JPEGs or coins. That conviction should come from real understanding: what problem does this project solve? Who’s behind it? What’s the roadmap? If you can’t answer those, you’re not investing you’re gambling.

And here’s the hard truth: most people in crypto markets are reacting, not thinking. If you want an edge, start learning. Education compounds. Know the difference between a technical correction and a dying project. Know when to hold and more importantly, why. Hype has a short shelf life. Knowledge doesn’t.

Looking Ahead

Crypto and NFT markets were born outside the system chaotic, experimental, and untamed. But that’s changing. Institutional players are stepping in, and when big money moves in, the rules start tightening.

Institutional influence tends to calm volatility not overnight, but gradually. Think banks, hedge funds, and asset managers adding crypto exposure. They’re not in it for wild rides. They want structure, predictability, and eventually, insurance. Their presence pushes toward infrastructure upgrades, clearer governance, and risk management, all of which nudge the market toward maturity.

Regulation plays a similar role. While too much red tape could choke innovation, clear boundaries help filter bad actors and create safer conditions for long term growth. You can already see the difference in how markets react to legal clarity versus legal uncertainty. Rulings from the SEC or new frameworks from the EU don’t just add rules they instantly adjust market behavior, tempering the extremes.

Still, the question hangs: is all this just another cycle wrapped in new packaging, or the start of a more sustainable era? Caution’s warranted. The volatility isn’t disappearing, just evolving. The real test is whether these changes lead to sturdier foundations or just a fancier house of cards.