Curious about the latest trends shaping the world of cryptocurrency adoption? In this article, I’ll delve into the dynamic landscape of crypto adoption trends that are revolutionizing the way we perceive and use digital currencies. From the surge in mainstream acceptance to the evolving regulatory environment, the realm of crypto adoption is experiencing a significant shift that’s worth exploring.

As I navigate through the intricate web of crypto adoption trends, I’ll uncover key insights into the factors driving this transformation. Whether it’s the growing interest from institutional investors or the increasing integration of blockchain technology into everyday transactions, the momentum behind crypto adoption is palpable. Join me on this journey to unravel the fascinating developments influencing the future of digital finance.

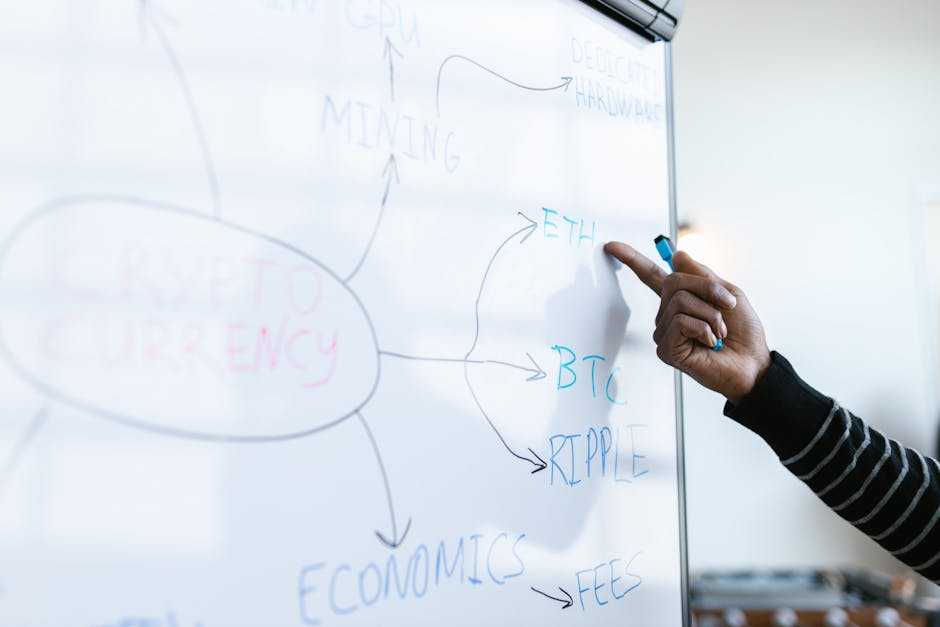

Overview of Crypto Adoption Trends

Exploring the current landscape of cryptocurrency adoption reveals intriguing shifts in the perception and utilization of digital currencies. Mainstream acceptance is on the rise, mirroring a changing regulatory environment and various driving forces propelling this evolution. Institutional investor interest and the integration of blockchain technology into everyday transactions significantly contribute to reshaping the future of digital finance. Join me as we delve into the dynamic developments that define the crypto adoption trends.

Factors Influencing Cryptocurrency Adoption

I have analyzed the key factors that influence the adoption of cryptocurrencies, shedding light on the critical aspects driving this progressive trend.

Technology Advancements

I believe that technological advancements play a pivotal role in driving cryptocurrency adoption. Innovations such as decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) have revolutionized the way digital assets are utilized and traded. The seamless integration of blockchain technology in various sectors has also contributed to the growing acceptance of cryptocurrencies as a legitimate means of financial transactions.

Regulatory Environment

In my assessment, the regulatory environment significantly impacts cryptocurrency adoption. Clear and favorable regulations can foster trust and confidence among investors, leading to increased participation in the crypto market. Conversely, stringent or uncertain regulatory frameworks may impede the growth of digital currencies and deter mainstream adoption. Monitoring regulatory developments is crucial for understanding the future trajectory of cryptocurrency adoption trends.

Global Adoption Patterns

Examining global adoption patterns of cryptocurrencies reveals fascinating insights into the evolving landscape of digital finance. It’s evident that different regions around the world exhibit unique behaviors and trends in embracing digital currencies. By dissecting these adoption patterns, we can glean valuable information on the future direction of crypto utilization.

- North America: In North America, crypto adoption is gaining momentum, with a notable increase in the number of businesses accepting digital currencies as a form of payment. Major companies like Tesla and PayPal now support cryptocurrency transactions, indicating a shift towards mainstream acceptance in this region.

- Europe: Similarly, Europe is also witnessing a surge in crypto adoption, driven by the growing popularity of decentralized finance platforms and the increasing use of cryptocurrencies in everyday transactions. Countries like Switzerland and Estonia are becoming hubs for blockchain innovation and adoption.

- Asia: In contrast, Asia remains a significant player in the crypto space, with countries like Japan and South Korea showing high levels of acceptance and integration of digital assets. The diverse regulatory environment across Asian countries influences the pace and scale of crypto adoption in this region.

- Africa: Emerging economies in Africa are embracing cryptocurrencies as a solution to financial inclusion challenges. With a large unbanked population, digital currencies offer a means of accessing financial services and participating in the global economy. Initiatives like mobile money and blockchain-based solutions are driving crypto adoption in Africa.

- South America: South America is also experiencing a growing interest in cryptocurrencies, fueled by economic instability and a desire for financial independence. Countries like Venezuela and Argentina have seen increased adoption of digital assets as a hedge against inflation and currency devaluation.

Examining these global adoption patterns highlights the diverse ways in which different regions are incorporating cryptocurrencies into their economic ecosystems. Understanding these trends can provide valuable insights for businesses, policymakers, and investors looking to navigate the evolving landscape of digital finance.

Challenges in Crypto Adoption

Reflecting on the landscape of crypto adoption, it’s vital to acknowledge the challenges that accompany this transformative journey. While advancements in technology and shifting regulations pave the way for broader acceptance, several obstacles impede seamless adoption. Understanding these hurdles is crucial for stakeholders navigating the evolving crypto ecosystem.

- Regulatory Uncertainty:

Navigating the regulatory landscape remains a significant challenge in crypto adoption. Divergent regulatory approaches across countries create a complex environment for businesses and investors. Ambiguity in regulations can deter mainstream adoption and investment, as uncertainties around compliance and legal implications persist. - Security Concerns:

Ensuring the security of digital assets is a paramount concern in the crypto space. The decentralized nature of cryptocurrencies and blockchain technology, while offering enhanced security features, also presents vulnerabilities. Risks such as hacking, phishing attacks, and smart contract vulnerabilities pose threats to users’ funds and data security. - Lack of Awareness and Education:

A lack of awareness and understanding about cryptocurrencies among the general population hinders widespread adoption. Misconceptions, myths, and limited knowledge about digital assets deter individuals from exploring and investing in cryptocurrencies. Education initiatives and accessible resources are essential to bridge this knowledge gap. - Scalability Issues:

Scalability remains a critical challenge for popular blockchain networks like Bitcoin and Ethereum. Limited transaction throughput, high fees during network congestion, and scalability bottlenecks hinder the seamless use of cryptocurrencies for everyday transactions. Enhancing scalability solutions is crucial to support mass adoption. - Volatility and Speculation:

The inherent volatility of crypto markets poses challenges for mainstream adoption. Price fluctuations and speculative trading behaviors can create barriers for risk-averse investors and businesses looking for stability. Addressing volatility through market maturation and regulatory mechanisms is key to fostering trust and sustainable adoption. - Interoperability and Integration:

Achieving interoperability between different blockchain platforms and traditional financial systems is a fundamental challenge for seamless crypto adoption. The lack of standardized protocols and integration frameworks impedes the efficient exchange of value across networks, hindering the mainstream integration of cryptocurrencies into existing payment systems.

Navigating these challenges requires a concerted effort from industry players, regulators, and the broader crypto community. Addressing regulatory uncertainties, enhancing security measures, promoting education, improving scalability solutions, stabilizing market volatility, and fostering interoperability are crucial steps towards overcoming hurdles and accelerating the adoption of cryptocurrencies on a global scale.