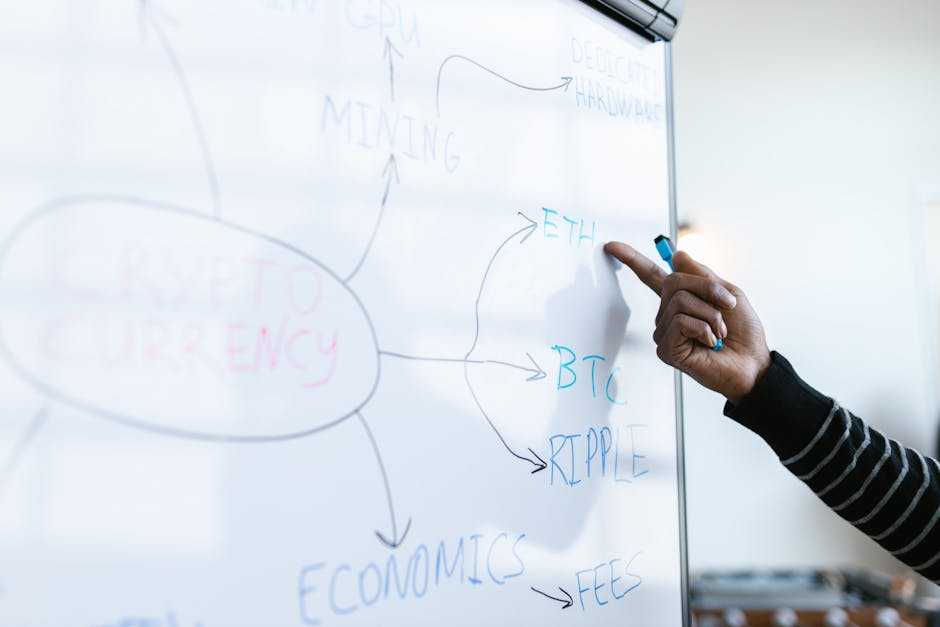

The Rise of Cryptocurrencies

The rise of cryptocurrencies marks a pivotal moment in the evolution of digital assets. This revolutionary technology has transformed financial landscapes and spurred the development of decentralized platforms.

Early Beginnings and Key Players

Cryptocurrencies, starting with Bitcoin in 2009, emerged from the desire for a decentralized financial system.

Satoshi Nakamoto’s whitepaper outlined the framework, highlighting Bitcoin’s potential to bypass traditional banking.

Bitcoin’s launch paved the way for other key players like Ethereum, which introduced smart contracts, and Ripple, known for its real-time gross settlement systems.

Impact on the Finance Sector

Cryptocurrencies have significantly impacted the finance sector. They offer lower transaction fees and faster transfer times compared to traditional banking.

These assets also provide financial services access to unbanked populations, promoting financial inclusion. Blockchain technology, the underlying framework, enhances transparency and reduces fraud, reshaping how markets operate.

Major financial institutions have started incorporating cryptocurrencies, further legitimizing these digital assets.

Transition to Mainstream Adoption

The transition to mainstream adoption of digital assets involves addressing various hurdles. From regulatory challenges to everyday use, many factors shape this phase.

Regulatory Challenges and Solutions

Regulatory challenges persist in the digital asset sector. Governments want to ensure consumer protection and prevent financial crimes. For example, the U.S. Securities and Exchange Commission (SEC) scrutinizes Initial Coin Offerings (ICOs) to curb fraudulent schemes.

Some solutions have emerged to address these concerns. Many cryptocurrency platforms now implement Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. These measures help in verifying user identity and monitoring suspicious transactions.

Global regulatory bodies are also stepping in. The Financial Action Task Force (FATF), an international watchdog, provides guidelines for countries to regulate digital assets effectively. These efforts aim to harmonize regulations and foster a safer ecosystem for users and investors.

Cryptocurrencies in Everyday Use

- Cryptocurrencies are becoming more integrated into daily life. Major companies like Tesla and Microsoft accept Bitcoin as a payment method, signaling a shift towards broader acceptance.

- Recently, El Salvador adopted Bitcoin as legal tender, encouraging everyday transactions using digital currency. This move highlights the growing acceptance of cryptocurrencies in traditional financial systems.

- Payment gateways like PayPal now support cryptocurrency transactions. Users can buy, hold, and sell digital assets through these platforms, making crypto more accessible to the general public.

- Retailers are also embracing digital assets. Companies like Overstock and Shopify allow customers to make purchases using cryptocurrencies, enhancing user choice and promoting mainstream usage.

- The mainstream adoption of digital assets navigates through regulatory landscapes and integrates cryptocurrencies into everyday transactions. This phase illustrates the dynamic evolution of digital assets in a rapidly changing world.

The Advent of NFTs

Non-fungible tokens, or NFTs, emerged as the latest innovation in digital assets. They introduced a new way to own, trade, and create digital content.

Defining Non-Fungible Tokens

NFTs represent unique digital items stored on a blockchain. Unlike cryptocurrencies, which are interchangeable, each NFT possesses distinct attributes.

Digital artists and creators mint NFTs to verify authenticity and ownership, making them ideal for artwork, music, and virtual real estate. Platforms like Ethereum, through ERC-721 and ERC-1155 standards, facilitate the creation and exchange of NFTs, ensuring secure, transparent transactions.

The Surge in Popularity of NFTs

NFT popularity skyrocketed in 2021. Sales of digital artworks, like Beeple’s “Everydays: The First 5000 Days,” fetched millions. Celebrities and major brands minted their own NFTs, adding to the hype.

This surge stemmed from the integration of blockchain technology with mainstream applications, attracting investors and enthusiasts alike. Marketplaces like:

- OpenSea

- Rarible

- Foundation

provided platforms for trading, significantly contributing to their widespread adoption.

The Interplay Between Cryptocurrencies and NFTs

Cryptocurrencies like Bitcoin and NFTs, although distinct, share technological and market interconnections. These relationships reveal much about the evolution of digital assets.

Technological Synergies

Cryptocurrencies and NFTs both leverage blockchain technology. Blockchain ensures transparency and security across transactions. For instance, Ethereum serves as the underlying network for most NFTs.

Smart contracts, integral to Ethereum, streamline NFT creation, transfer, and ownership. Decentralized apps (dApps) rely on blockchains to function, integrating both cryptocurrencies and NFTs in ecosystems such as gaming and virtual real estate.

These applications showcase seamless operations in decentralized environments.

Market Dynamics

The markets for cryptocurrencies and NFTs show dynamic interactions. Cryptocurrencies often fund NFT purchases, demonstrated by marketplaces like OpenSea accepting payments in Ether.

The volatile nature of crypto values influences NFT pricing and investment strategies. For instance, during Bitcoin surges, the NFT market sees increased activity.

Crypto whales, holding substantial amounts of digital currency, significantly impact NFT sales and trends. Moreover, integration into mainstream financial systems, illustrated by PayPal enabling crypto transactions, extends to NFTs, increasing access and broadening market participation.

These synergies and dynamics illustrate the interwoven nature of cryptocurrencies and NFTs, expanding digital asset functionalities.

Future Outlook for Digital Assets

The future of digital assets promises significant evolution. Emerging technologies and market dynamics signal unprecedented growth and challenges.

Innovations on the Horizon

Innovations in digital assets focus on interoperability and scalability. Technologies like cross-chain bridges enable assets to move between blockchains, enhancing liquidity and usability.

Layer 2 solutions increase transaction speed and reduce fees, addressing blockchain limitations.

Decentralized finance (DeFi) integrates with traditional finance, offering hybrid financial products. Quantum computing could revolutionize blockchain security, though its impact remains speculative.

Trends point towards more user-friendly platforms, improving accessibility and adoption rates among non-technical users.

Potential Challenges and Opportunities

Regulatory uncertainty remains a significant challenge. Governments globally work on frameworks, but inconsistent policies create compliance complexities.

Market volatility affects investor confidence; stablecoins aim to mitigate this. Scalability issues persist despite Layer 2 advancements, necessitating further innovation. Cybersecurity threats grow as digital assets gain value, demanding robust defense mechanisms.

Opportunities abound in sectors like gaming, real estate, and intellectual property, where digital assets can redefine ownership and monetization. Education and awareness initiatives will be crucial for mainstream adoption, helping users navigate this evolving landscape confidently.