Web3: More than a Buzzword

Web3 is no longer just a tech industry talking point it represents a foundational shift in how digital systems are built and governed. At its core, Web3 challenges the traditional model of centralized control over online platforms, instead offering a vision rooted in distributed ownership, transparency, and user empowerment.

Core Principles of Web3

At the heart of the Web3 movement are three transformative ideas:

Decentralization: Shifting control from corporations to communities, with decentralized networks replacing centralized servers.

Transparency: Every transaction, vote, or action is verifiable on a public ledger, increasing trust and accountability.

Ownership: Individuals can truly own digital assets, identities, and even parts of the platforms they use.

Breaking Away from Gatekeepers

In Web2, users create value through content, data, and engagement but it’s the platforms that profit. Web3 flips that model by:

Empowering users to own their data, not just rent space on someone else’s servers

Enabling creators to monetize directly without intermediaries

Redistributing power traditionally held by tech giants back to users and developers

Blockchain: The Backbone of Web3

The technological foundation of Web3 lies in blockchain networks. These distributed ledgers:

Store data across nodes rather than on centralized servers

Make transactions auditable, secure, and immutable

Enable smart contracts that power decentralized apps (dApps) and automated interactions

Without blockchain infrastructure, the promises of Web3 like decentralized identities, secure peer to peer exchanges, and tokenized economies would remain theoretical. As blockchain matures and scales, it solidifies the foundation on which the future of digital economies will be built.

Shifting Power in Digital Economies

Web2 gave platforms all the leverage. They owned the data, dictated the rules, and monetized user engagement while creators scrambled for scraps. Web3 flips that script.

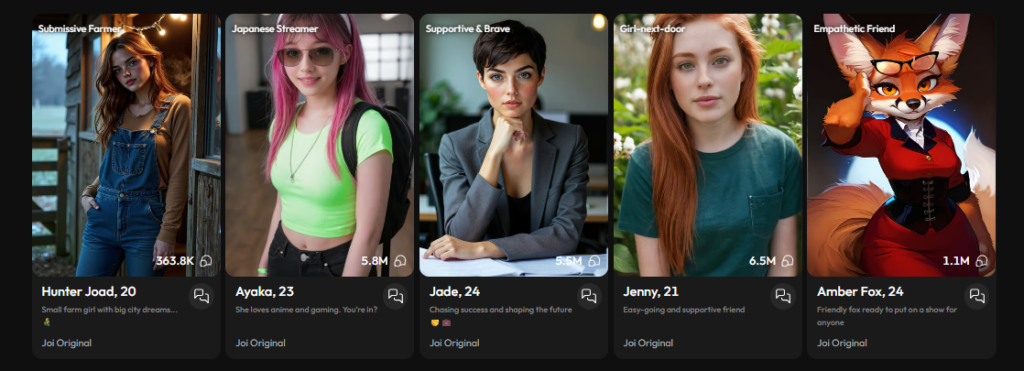

In a user centric system, creators are no longer just content suppliers feeding a black box algorithm they become stakeholders. Smart contracts make payments automatic and transparent. Tokenization means a video, a music drop, or even access to a community can be tracked, traded, or monetized without relying on a middleman. This isn’t theoretical it’s already happening across decentralized video platforms and creator DAOs.

Then there’s data. In a Web3 world, your digital trail isn’t someone else’s business model. It’s yours. Own it, store it, share it or don’t. The power shifts from platforms to individuals, challenging the old norms of renting space on someone else’s app.

For creators, this version of the internet isn’t just about better tools. It’s about sovereignty. And it’s changing the definition of digital work, one contract at a time.

Decentralized Finance (DeFi) Leading the Charge

No hype here DeFi is legitimately rewriting the rules of finance. It’s not just tech jargon anymore; it’s a real alternative to the banking system. Platforms built on blockchain are eliminating traditional middlemen in lending, borrowing, and trading. No banks. No brokers. Just code handling transactions peer to peer.

This shift is more than ideological. It’s functional. You’ve got people in developing regions getting loans straight from a smartphone, using crypto as collateral. Yield farming, liquidity pools, and decentralized exchanges (DEXs) are giving users actual control over how they move, grow, or stake their money. And protocols like Aave or Compound? They’re behaving less like startups and more like miniature, algorithmic banks just without the brick and mortar and overhead.

The craziest part? These systems run 24/7. No closing bell. No holidays.

People are starting to catch on. From freelancers getting paid directly in stablecoins to small investors swapping assets without waiting three business days, the use cases are multiplying and fast.

Explore more in depth on the rise of DeFi

Token Economies and Incentive Alignments

In Web3, tokens aren’t just symbols on a screen they’re the fuel for participation and progress. Utility tokens give users access to services, perks, or exclusive content within a platform. Think of them like keys that unlock value. Governance tokens, on the other hand, represent voice. They let users vote on protocol changes, community guidelines, or how funds get used. In other words, they turn passive consumers into active stakeholders.

This shift realigns the value chain. Instead of platform owners holding all the cards, value is distributed among the people who actually use, build, and grow the ecosystem. When users hold tokens, they own part of the story. That naturally builds stronger communities, tighter feedback loops, and more transparency.

Then there are DAOs Decentralized Autonomous Organizations. These are internet native collectives that run on smart contracts rather than top down leadership. DAOs allow communities to pool funds, make shared decisions, and launch initiatives democratically. Whether it’s funding new features or managing partnerships, everyone with skin in the game gets a say. Web3 isn’t pretending to be egalitarian it’s threading governance into the code.

Challenges to Watch

Web3 shows promise, but it’s still dragging some heavy baggage. First, regulation. No one quite agrees on where the lines are, and most countries haven’t inked clear policies. Terms like “security” and “commodity” get thrown around carelessly, causing confusion for creators and projects alike. One misstep, and a startup could end up in legal limbo. Navigating compliance right now isn’t just tricky it’s borderline guesswork.

Then there’s the issue of scale. Decentralization sounds clean on paper, but on chain transactions are often slow and costly. Many blockchains face congestion and high gas fees. Infrastructure is improving, but not fast enough to support mass adoption. Most users won’t tolerate delays or clunky interfaces, and that’s a real problem.

Which brings us to the user experience gap. Web3 tools too often feel like they were built for developers, not everyday people. Wallets, seed phrases, bridges most of it is unintuitive to someone coming from the ease of Web2 platforms. If the promise of ownership and decentralization is going to reach more users, the experience needs to be simple, fast, and safe. Right now, it’s not.

So the mission in 2024 is clear: clarify the legal landscape, scale infrastructure that can handle growth, and make the onramp painless for everyone else.

Looking Ahead

Web3’s long term success doesn’t rest on hype it depends on making the tech actually usable. That means prioritizing three pillars: security, accessibility, and education. People won’t pour their lives and livelihoods into decentralized systems if they don’t trust the foundation. Platforms need to be robust enough to guard against breaches while maintaining the transparency that makes Web3 appealing in the first place.

Accessibility is the second bottleneck, and maybe the most urgent. Navigating wallets, gas fees, or DAOs still feels like learning a new language. If Web3 wants to go mainstream, it has to stop speaking in developer dialect and start building for everyone else. We’re talking clean interfaces, simple onboarding flows, and clear value from the first click.

That’s where education comes in. Not just tutorials, but context. Users need to know why decentralization matters, not just how to mint an NFT. Vloggers, creators, developers there’s a role for all of them in shaping this narrative.

In the end, Web3 isn’t here to tear down the entire digital economy. It’s here to evolve it. The point isn’t to replace what works. It’s to rewire what’s broken. Slowly, steadily, and with a lot more people at the table.

Further reading: The rise of DeFi and its foundational role in shaping Web3