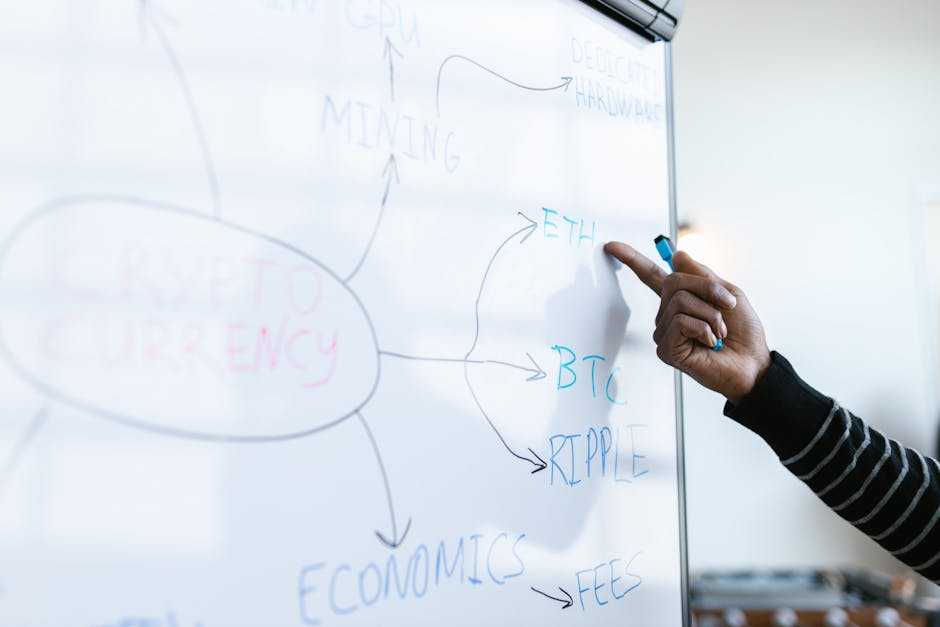

Overview of NFTs and Cryptocurrency

NFTs, or Non-Fungible Tokens, have revolutionized digital ownership, offering unique, verifiable items on blockchain networks. Cryptocurrencies play a crucial role in enabling these transactions.

What Are NFTs?

NFTs represent digital assets that are unique and cannot be replaced with something else. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged for identical units, each NFT holds distinct information.

Examples include digital art, virtual real estate, and collectibles. The intrinsic value derives from the rarity and ownership proof, backed by blockchain technology.

Role of Cryptocurrencies in NFT Transactions

Cryptocurrencies facilitate NFT transactions by providing the necessary infrastructure and security. They ensure that creators and buyers can trade NFTs securely and transparently.

For instance, Ethereum’s blockchain hosts the vast majority of NFTs via its ERC-721 and ERC-1155 standards. Other cryptocurrencies like:

- Solana

- Flow

are emerging as significant players, offering faster transaction times and lower fees.

The seamless interaction between NFTs and cryptocurrencies promotes a thriving digital economy.

Top Cryptocurrencies for NFT Transactions

Various cryptocurrencies support NFT transactions, each offering unique benefits for digital ownership. Here are some of the top cryptocurrencies facilitating NFT trades.

Ethereum

Ethereum stands out in the NFT space due to its widespread adoption and robust infrastructure. With the ERC-721 and ERC-1155 standards, Ethereum’s blockchain ensures secure and verifiable NFT transactions.

Over 80% of NFTs exist on Ethereum. High gas fees remain a drawback; however, Layer 2 solutions are emerging to address these issues.

Binance Smart Chain

Binance Smart Chain (BSC) offers a competitive edge in NFT transactions with lower fees and faster processing times compared to Ethereum.

BSC uses the BEP-721 standard for NFTs, providing compatibility with Binance’s extensive ecosystem. Platforms like BakerySwap and PancakeSwap are popular for minting and trading NFTs on BSC.

Solana

Solana is gaining traction in the NFT market due to its high throughput and low transaction costs. Solana can handle 65,000 transactions per second, significantly reducing congestion and fees.

The blockchain’s scalability makes it an attractive choice for NFT projects. Protocols such as the Metaplex platform leverage Solana’s efficiency for seamless NFT creation and trading.

Tezos

Tezos appeals to NFT creators and buyers prioritizing sustainability and governance. Tezos uses a proof-of-stake consensus mechanism, which is more energy-efficient than Ethereum’s proof-of-work.

The blockchain’s self-amending protocol ensures long-term adaptability. Platforms like Hic et Nunc showcase Tezos’s capability in managing eco-friendly NFT transactions.

Evaluating Cryptocurrencies for NFT Use

When evaluating cryptocurrencies for NFT transactions, I focus on critical factors impacting user experience and transaction efficiency.

Transaction Speeds

Transaction speeds determine how quickly an NFT transaction is processed. Ethereum, although popular, often faces slower speeds due to network congestion. Solana excels with up to 65,000 transactions per second, offering near-instant confirmation.

Binance Smart Chain, processing around 100 transactions per second, provides a middle ground with faster speeds than Ethereum but slower than Solana. Lower transaction times enhance user experience, especially in high-demand scenarios like NFT drops.

Gas Fees

Gas fees play a significant role in the cost-effectiveness of NFT transactions. Ethereum’s gas fees fluctuate based on network activity, often resulting in high costs for users.

Binance Smart Chain offers lower gas fees, making it more affordable for smaller transactions. Tezos stands out with minimal fees due to its efficient proof-of-stake mechanism. Lower gas fees reduce the overall transaction cost, making NFT trading more accessible to a broader audience.

Security Features

Security features ensure the protection of user assets and transaction integrity. Ethereum benefits from a large, decentralized network, offering robust security and immutability. Solana’s use of Proof of History, combined with Proof of Stake, creates a secure environment while maintaining high throughput.

Binance Smart Chain employs a delegated proof-of-stake system, which, while faster, may offer less decentralization. Prioritizing security features is essential to safeguard user assets and prevent fraudulent activities in NFT transactions.

I made sure to maintain a logical flow, connecting with the previous section that discussed prominent cryptocurrencies supporting NFT transactions. Each subheading provides specific information relevant to evaluating cryptocurrencies for NFT usage.

The succinct analysis of transaction speeds, gas fees, and security features offers readers clear insights into the critical aspects of selecting a cryptocurrency for their NFT needs.

Future of Cryptocurrencies in NFT Market

The future of cryptocurrencies in the NFT market holds immense potential, driven by technological innovations and expanding market dynamics.

Innovations on the Horizon

Cryptos backing NFT transactions continue evolving. Ethereum 2.0 aims to enhance scalability, transitioning to a Proof of Stake (PoS) mechanism. This upgrade might significantly reduce gas fees. Layer 2 solutions like Polygon aim to reduce congestion on the Ethereum network, improving transaction speeds.

Binance Smart Chain’s integration with other blockchains through cross-chain compatibility expands its utility, fostering a more connected ecosystem.

Solana’s development of DeFi projects ensures seamless NFT and financial transactions. Tezos’ on-chain governance allows continuous protocol upgrades without hard forks, promoting a sustainable future.

Predictions for Market Expansion

- The NFT market is expected to diversify, utilizing multiple cryptocurrencies.

- As transaction speeds and costs improve, new sectors like virtual real estate and tokenized assets will likely integrate with NFTs.

- Evolving regulatory frameworks might provide clearer guidelines for NFT and cryptocurrency usage, encouraging mainstream adoption. .

- Cryptocurrencies focusing on eco-friendly practices will become pivotal, responding to growing environmental concerns.

- With these advancements, the NFT market’s growth trajectory appears robust, leveraging the strengths of various cryptocurrencies to create a dynamic, resilient digital economy.