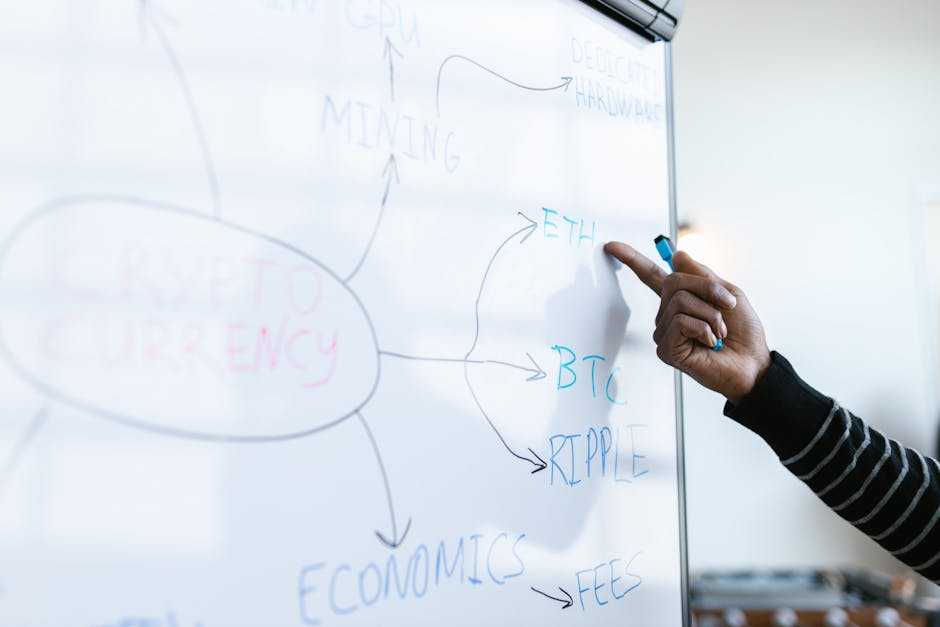

Understanding Market Volatility in Crypto and NFTs

Market volatility in crypto and NFTs presents unique challenges for investors. To navigate this landscape, it’s crucial to grasp the factors driving volatility and compare the differences between crypto and NFT markets.

What Causes Volatility in These Markets?

Several factors cause volatility in crypto and NFT markets:

- Speculation: High speculation and investor hype often drive prices. For instance, tweets from influential figures can cause significant price swings.

- Market Liquidity: Low liquidity, especially in NFT markets, can lead to abrupt price changes. Thinly traded assets are more susceptible to price manipulation.

- Regulatory News: Announcements regarding regulations impact market sentiment. News of potential bans or endorsements can lead to sharp price fluctuations.

- Technological Developments: Advancements or setbacks in blockchain technology influence market perception. For example, upgrades or security breaches cause volatility.

- Macroeconomic Factors: Broader economic trends, such as inflation or interest rates, affect investment behavior. Investors might flock to or flee from crypto and NFTs based on economic outlooks.

Comparing Volatility Between Crypto and NFTs

Understanding the differences in volatility between crypto and NFTs helps investors strategize:

- Market Maturity: Cryptocurrencies have been around longer and hence might exhibit slightly more stability compared to the nascent NFT market.

- Liquidity: Cryptocurrencies generally have higher liquidity. Major cryptocurrencies like Bitcoin and Ethereum are traded across numerous exchanges, while NFTs often depend on niche platforms, leading to higher price variability.

- Market Size: The total market cap of cryptocurrencies dwarfs that of NFTs. Larger markets tend to be less volatile as they can absorb shocks more effectively.

- Use Cases: Crypto’s use cases are broad, ranging from payment solutions to smart contract platforms. NFTs primarily represent ownership of digital assets, causing their value to be more subjective and volatile.

By understanding these causes and comparisons, I can make more informed decisions in crypto and NFT investments, aiming to mitigate risks associated with market volatility.

Key Factors Driving Market Fluctuations

Market volatility in crypto and NFTs stems from various dynamics. Understanding these drivers is essential for making informed investment decisions and managing risks effectively.

The Role of Media and Information

Media and information play a significant role in market movements. News articles, social media posts, and even celebrity endorsements can spark sudden changes in asset prices.

A single tweet from a well-known figure, for instance, might drive significant price surges or drops. Investors often react quickly to news, causing rapid fluctuations. Tracking trustworthy sources helps cut through misinformation and respond appropriately to market shifts.

Impact of Regulatory Changes

Regulatory changes greatly influence market volatility. Announcements from government agencies on new regulations or enforcement can lead to sharp market responses.

For example, when a country bans cryptocurrency transactions, the market typically sees an abrupt drop in prices. Conversely, regulatory acceptance can boost confidence, causing upward trends.

Staying updated on policy changes in major regions helps anticipate and react to these market shifts.

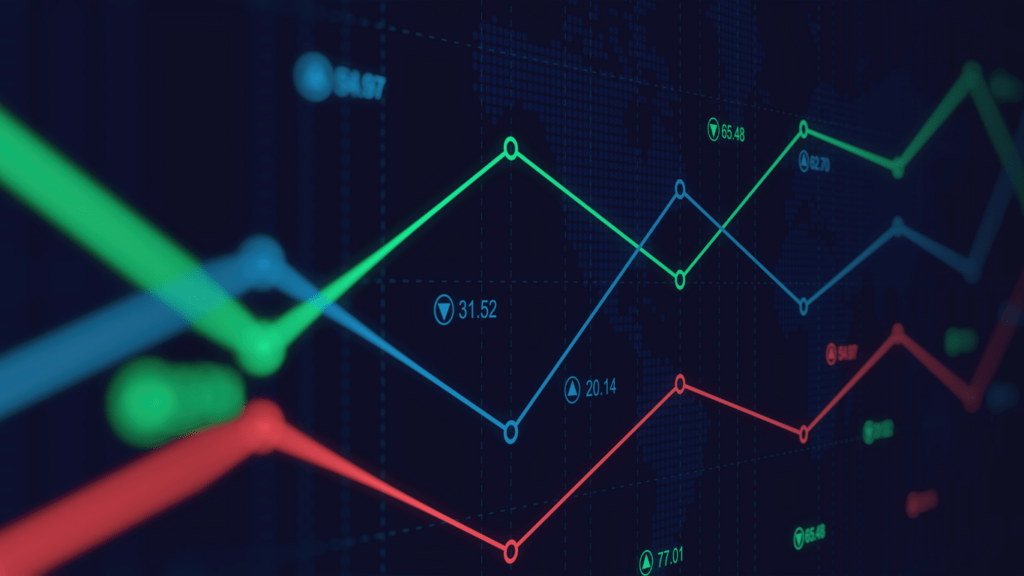

Historical Trends in Crypto and NFT Markets

Significant Volatile Events and Their Outcomes

Cryptocurrency and NFT markets have experienced numerous volatile events. In December 2017, Bitcoin reached an all-time high of around $19,783 before plummeting to nearly $3,200 by December 2018.

This drastic drop, known as the “crypto winter,” highlighted the speculative nature and extreme volatility of the crypto market.

Similarly, in February 2021, NFT sales surged when digital artist Beeple’s NFT sold for $69 million. Yet, by mid-2021, the NFT market experienced sharp declines in sales volume and value.

Lessons Learned from Past Market Behaviors

Analyzing past behaviors in these markets reveals essential lessons. Investors must recognize the inherent risks of speculative bubbles, as seen in the 2017 Bitcoin surge and 2021 NFT boom.

Diversification is crucial; relying solely on one asset type can lead to significant losses, as proven during market downturns.

Moreover, historical trends underscore the importance of staying informed about market dynamics and external influences, like regulatory changes and technological advancements, which drive volatility.

Strategies to Mitigate Risks

Managing volatility in crypto and NFT markets is crucial for protecting investments. Implementing effective strategies can help navigate these unpredictable markets.

Diversification and Portfolio Management

Diversifying investments reduces exposure to any single asset’s volatility. I spread my investments across various cryptocurrencies and NFTs to cushion potential losses.

A balanced portfolio includes assets with different risk profiles, which can provide stability in turbulent markets. Regularly reviewing and adjusting holdings based on market conditions keeps my portfolio aligned with my risk tolerance and investment goals.

Utilizing Technology and Expert Advice

Leveraging technology enhances investment decision making. I use portfolio management tools to track performance and set alerts for market changes.

Automated trading platforms and bots can execute strategies quickly, reducing reaction time to market shifts. Consulting with financial advisors and crypto experts provides insights into market trends and risk management techniques.

They offer a wealth of knowledge that can guide investment decisions and help navigate complex market dynamics.