Understanding DeFi, Crypto, and NFTs

In the digital financial landscape, DeFi, crypto, and NFTs form the backbone of new and exciting economic opportunities. Each element offers unique functionalities and benefits.

Basics of Decentralized Finance (DeFi)

DeFi, short for Decentralized Finance, aims to disrupt traditional financial systems by removing intermediaries. It leverages blockchain technology to create decentralized applications (dApps) that provide financial services like:

- lending

- borrowing

- trading

without banks.

According to DeFi Pulse, the total value locked in DeFi protocols exceeded $80 billion in 2022, showcasing its explosive growth. Prominent platforms include Uniswap and Aave.

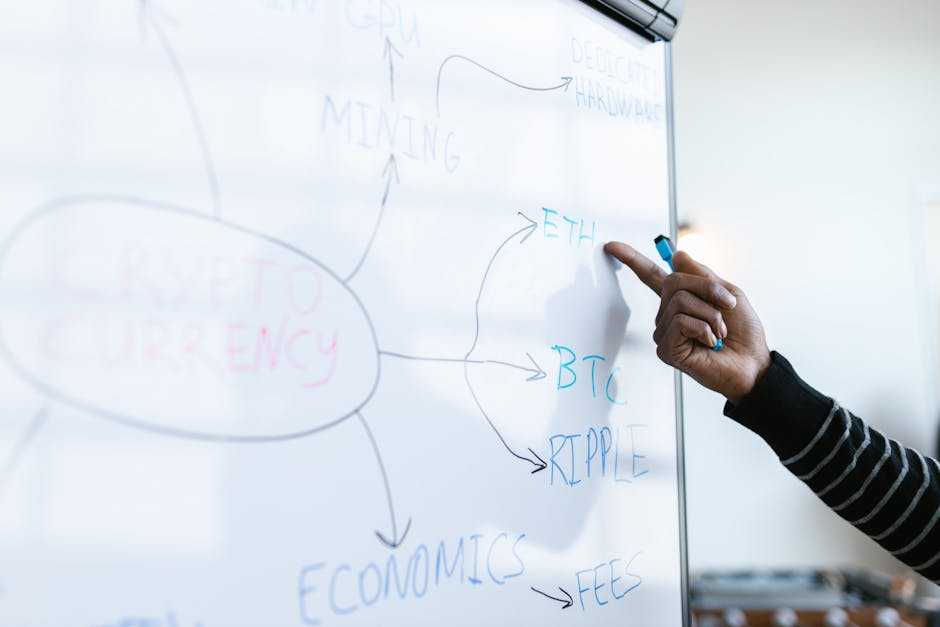

Fundamentals of Cryptocurrency

Cryptocurrency refers to digital or virtual currencies that use cryptography for security, operating on decentralized networks based on blockchain technology.

Bitcoin, the first and most well-known cryptocurrency, introduced the concept of decentralized digital currency in 2009. Ethereum, another major cryptocurrency, extends blockchain’s capabilities with smart contracts, enabling various decentralized applications.

Data from CoinMarketCap showed over 18,000 cryptocurrencies in circulation as of 2023.

Introduction to Non-Fungible Tokens (NFTs)

NFTs, or Non-Fungible Tokens, revolutionize ownership and value in the digital space. Unlike cryptocurrencies, NFTs represent unique digital items, verifying ownership through blockchain technology.

These can include digital art, music, and virtual real estate. In 2021, an NFT artwork by Beeple was sold for $69 million, highlighting the significant economic potential of NFTs. Popular NFT marketplaces include OpenSea and Rarible.

By exploring DeFi, crypto, and NFTs, one can better understand the evolving digital financial ecosystem. Anchoring these concepts creates unique investment strategies and offers novel ways to trade and own assets.

How DeFi Integrates with Cryptocurrency

DeFi seamlessly integrates with cryptocurrency using blockchain technology and smart contracts. This section breaks down how these elements intersect to create a robust financial ecosystem.

The Role of Blockchain Technology

- Blockchain technology underpins both DeFi and cryptocurrency.

- It ensures transparency and security by recording transactions on a decentralized ledger.

- Cryptocurrencies like Bitcoin and Ethereum use blockchain for secure peer-to-peer transactions rather than relying on centralized institutions.

- DeFi platforms leverage this technology to provide decentralized financial services, enabling users to lend, borrow, and trade assets directly.

- Lending protocols like Aave and Compound facilitate cryptocurrency loans using smart contracts and blockchain for reliability and transparency.

Smart Contracts and DeFi

Smart contracts execute automated transactions based on predefined conditions. Stored on the blockchain, these contracts ensure trustless and transparent interactions.

DeFi platforms rely heavily on smart contracts to offer services like lending, staking, and trading without intermediaries. For instance, Uniswap allows users to trade cryptocurrencies directly using smart contracts.

This eliminates the need for a central authority, ensuring lower fees and faster transactions. By integrating smart contracts, DeFi platforms create a secure and efficient financial ecosystem that complements the decentralized nature of cryptocurrencies.

NFTs in the DeFi Ecosystem

Non-fungible tokens (NFTs) bring unique characteristics to the DeFi ecosystem, enhancing both asset utilization and liquidity options.

Using NFTs as Collateral

NFTs serve as collateral in DeFi platforms, enabling users to access loans. For instance, platforms like NFTfi allow individuals to use their NFTs to obtain cryptocurrency loans.

Users pledge their NFTs as security, and in return, they receive crypto assets, enabling liquidity without selling their valuable NFTs. The process uses smart contracts to ensure transparency and trustworthiness.

Unique NFTs and Their Impact on DeFi

Unique NFTs impact DeFi by introducing new asset classes. Digital artworks, virtual real estate, and in-game items can now become part of the DeFi market.

For example, fractional ownership of high-value NFTs permits investors to own fractions of NFTs, making it easier to diversify portfolios. Platforms like Unicly and Fractional facilitate these transactions, merging uniqueness with investment opportunities in the DeFi space.

Future Trends at the Intersection of DeFi, Crypto, and NFTs

The intersection of DeFi, crypto, and NFTs continues to evolve, presenting exciting future trends and potential challenges. Understanding these developments helps anticipate the digital financial landscape’s trajectory.

Predictions and Emerging Technologies

Next-generation blockchain platforms, such as:

- Ethereum 2.0

- Cardano

aim to enhance scalability, security, and interoperability, impacting DeFi, crypto, and NFTs.

Ethereum 2.0’s shift to a proof-of-stake consensus mechanism greatly improves energy efficiency and transaction speed. Cardano’s unique architecture, with separate layers for settlement and computation, offers enhanced flexibility for developers.

AI and machine learning improve DeFi platforms’ efficiency and security. Predictive analytics identify market trends, while automated trading algorithms optimize asset management.

Additionally, cross-chain technology fosters interoperability between different blockchain networks. Projects like Polkadot and Cosmos enable seamless asset and data transfer across multiple chains, broadening the scope of decentralized applications.

Regulatory Challenges and Opportunities

Regulatory frameworks for DeFi, crypto, and NFTs see increased scrutiny from global governments. These digital assets’ decentralized nature presents unique challenges for traditional regulation.

For instance, the US Securities and Exchange Commission (SEC) considers many crypto assets as securities, thus subject to existing laws. This stance forces platforms to navigate compliance complexities.

At the same time, regulatory clarity promotes industry growth. Countries like Switzerland and Singapore develop favorable regulations that bolster innovation.

Collaboration between the crypto industry and regulatory bodies fosters a safer, more transparent market environment.

Regulatory sandboxes, where companies can test innovations with relaxed regulations, provide opportunities for exploring new applications without significant legal risks.

Understanding these trends and challenges at the intersection of DeFi, crypto, and NFTs positions us to navigate the evolving digital financial ecosystem effectively.