Overview of Current Regulatory Changes in Crypto and NFTs

Cryptocurrencies and NFTs are experiencing significant shifts due to emerging regulations. Understanding these changes helps stakeholders navigate the evolving landscape.

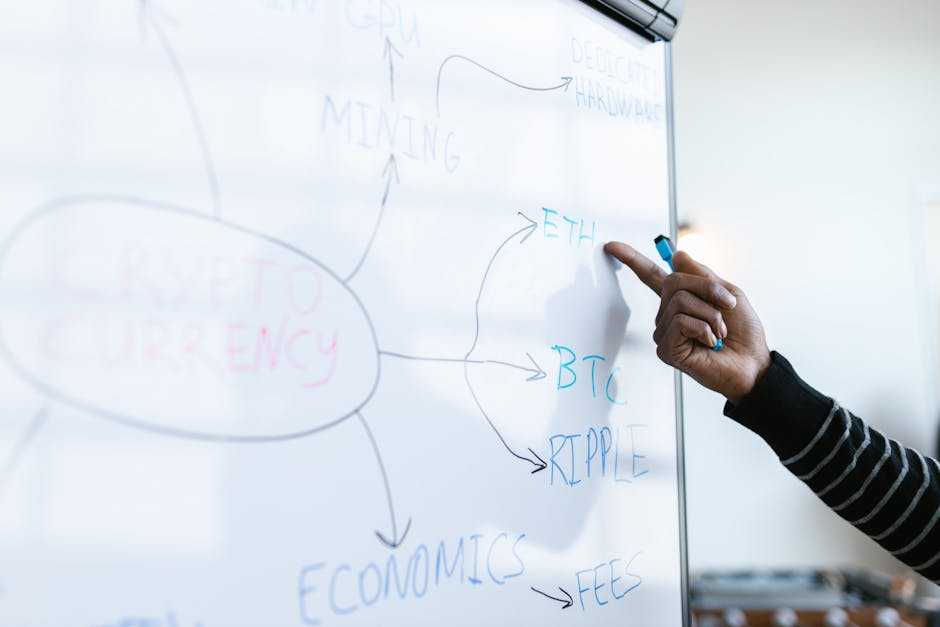

The Role of Major Regulatory Bodies

Major regulatory bodies worldwide influence the crypto and NFT markets. In the US, the Securities and Exchange Commission (SEC) oversees securities regulations, impacting Initial Coin Offerings (ICOs) and certain NFTs.

The Commodity Futures Trading Commission (CFTC) regulates derivative markets, including Bitcoin futures. Globally, the Financial Action Task Force (FATF) sets international standards for anti-money laundering (AML) and counter-terrorism financing (CTF).

Key Regulations Introduced in the Past Year

Recent regulations highlight the drive to control crypto and NFT activities. The US Infrastructure Bill mandated tax reporting for digital assets, increasing transparency.

The European Union introduced the Markets in Crypto-Assets (MiCA) framework to establish comprehensive regulation. China tightened its ban on crypto transactions, significantly impacting market dynamics.

Impact of Regulations on Cryptocurrency Markets

Regulatory changes have brought significant shifts to cryptocurrency markets. These shifts affect exchanges, trading platforms, and individual investors alike.

Effects on Crypto Exchanges and Trading Platforms

Crypto exchanges and trading platforms face strict compliance requirements due to new regulations. For instance, many platforms now adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) rules.

These mandates help prevent fraud and ensure transparency. Exchanges failing to comply risk penalties or shutdowns, which impacts their user base and trading volume.

In addition, regulations often dictate the types of assets that platforms can list. For example, the SEC has identified certain tokens as securities, which can only be traded on compliant platforms. This limits the availability of some cryptocurrencies to users.

Impact on Crypto Investors and Holders

Crypto investors and holders encounter increased scrutiny and reporting obligations.

- The US Infrastructure Bill, for instance, requires brokers to report crypto transactions for tax purposes. This affects every user, from small traders to large investors.

- Regulatory uncertainty can lead to market volatility.

- Sudden announcements, like China’s crypto ban or new SEC guidelines, often cause price fluctuations.

- Investors need to stay informed about regulatory changes to manage risks properly.These regulations also influence where investors can hold or use their assets.

- Some jurisdictions with stricter laws may limit the activities of crypto holders, while others with clearer regulations provide a safer investment environment.

Impact of Regulations on NFT Markets

Regulatory changes are dramatically affecting the NFT markets, leading to shifts in trading practices and influencing creators and collectors.

Changes in NFT Trading Practices

Regulations require NFT marketplaces to implement strict KYC and AML procedures. These measures, aimed at preventing fraud and ensuring transparency, mandate users to verify identities and provide detailed transaction histories.

Non-compliant platforms risk severe penalties or shutdowns, which can deter participation and reduce trading volumes.

Additionally, the classification of NFTs as commodities or securities complicates their trading, as securities are subject to stricter regulatory scrutiny.

For example, if an NFT is deemed a security, platforms must register with financial authorities, increasing operational costs and limiting the types of NFTs available for trading.

Influence on NFT Creators and Collectors

- Regulations impact NFT creators by imposing requirements on the types of digital works that can be minted and sold, limiting creative freedom.

- For collectors, compliance results in increased costs and complexities in acquiring, holding, and selling NFTs.

- Enhanced reporting obligations mean collectors must disclose holdings and transactions, potentially leading to higher taxes and fees.

- The volatility induced by regulatory announcements affects the value of NFT collections, making it crucial for collectors to stay informed about legal developments to manage risks effectively.

Future Trends and Predictions

Regulatory changes significantly impact the future of cryptocurrency and NFTs. Emerging trends suggest important shifts in the landscape.

Potential Regulatory Movements

Several jurisdictions plan stricter regulations on cryptocurrencies, targeting tax evasion and money laundering. The European Union has proposed the Markets in Crypto-Assets (MiCA) regulation, focusing on creating a unified framework for the whole EU.

In the US, the SEC examines whether more digital assets qualify as securities, increasing reporting standards and oversight. Countries like China continue to ban crypto trading, pushing global markets to reassess their strategies.

Adaptation Strategies for Crypto and NFT Entities

Crypto and NFT entities must adapt quickly to thrive. Adopting robust compliance measures is essential to meet evolving KYC and AML requirements. Entities use blockchain analytics tools to monitor transactions and prevent illicit activities.

Decentralized platforms are exploring hybrid models to balance decentralization while complying with regulations. Educating investors about regulatory landscapes and promoting transparency can improve trust.

Collaboration with regulators helps shape favorable policies, driving sustainable growth in the sector.