Understanding the Crypto Market

To invest in crypto intelligently, one must grasp essential concepts and recognize prevalent trends.

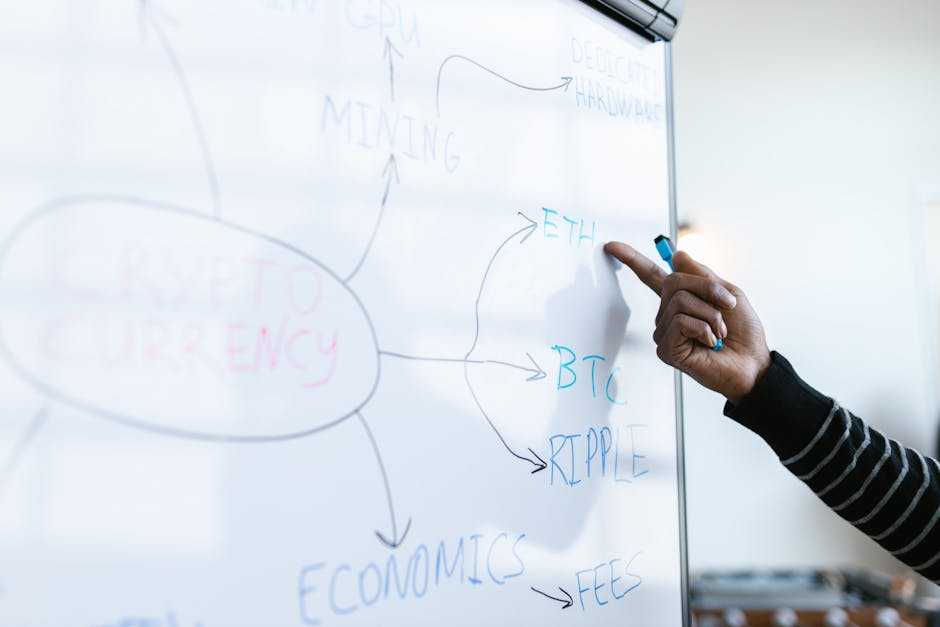

Key Concepts and Terminology

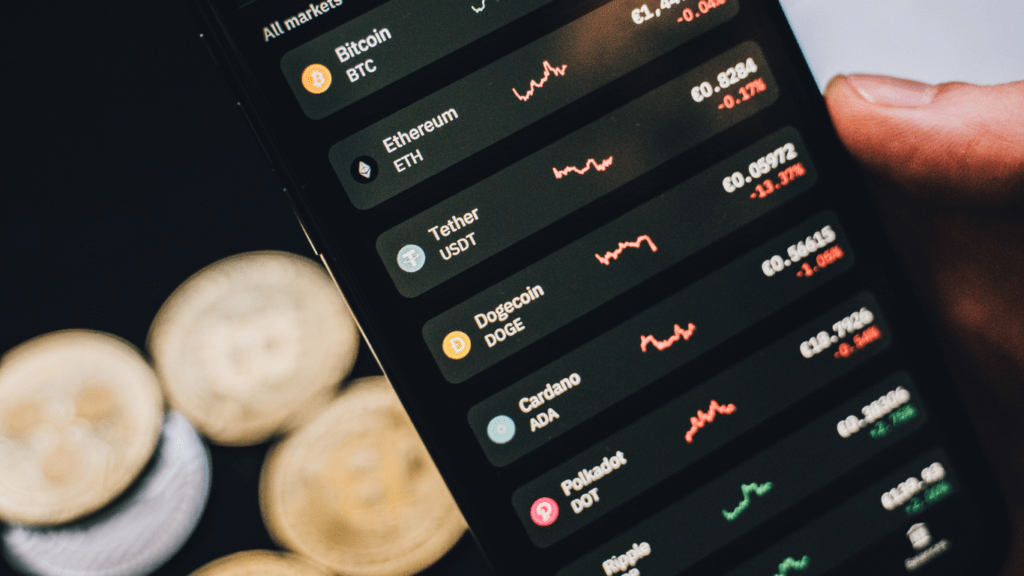

Digital currencies like Bitcoin and Ethereum dominate the market, influencing other digital assets. A blockchain is a decentralized ledger where crypto transactions get recorded.

Miners validate these transactions by solving complex algorithms, earning new tokens as a reward.

Smart contracts are code on blockchains that execute automatically when preset conditions are met, popularized by Ethereum. Decentralized finance (DeFi) refers to financial services using smart contracts instead of intermediaries.

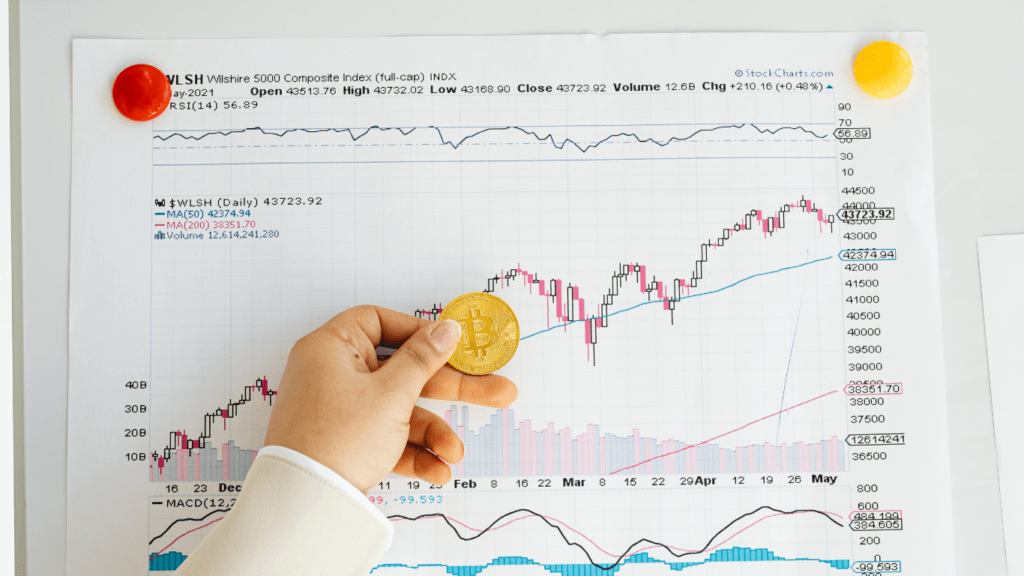

Market Trends and Influences

Crypto market trends include bullish and bearish cycles, often correlated with global economic events and regulatory news. Institutional investment has surged, indicating growing mainstream acceptance.

Bitcoin dominates the market, comprising about 60% of total crypto market capitalization, often setting the tone for other cryptos.

Initial Coin Offerings (ICOs) and more recently Security Token Offerings (STOs) have emerged as fundraising methods. Social media and influential figures can significantly impact investor sentiment and market trends.

The World of NFTs

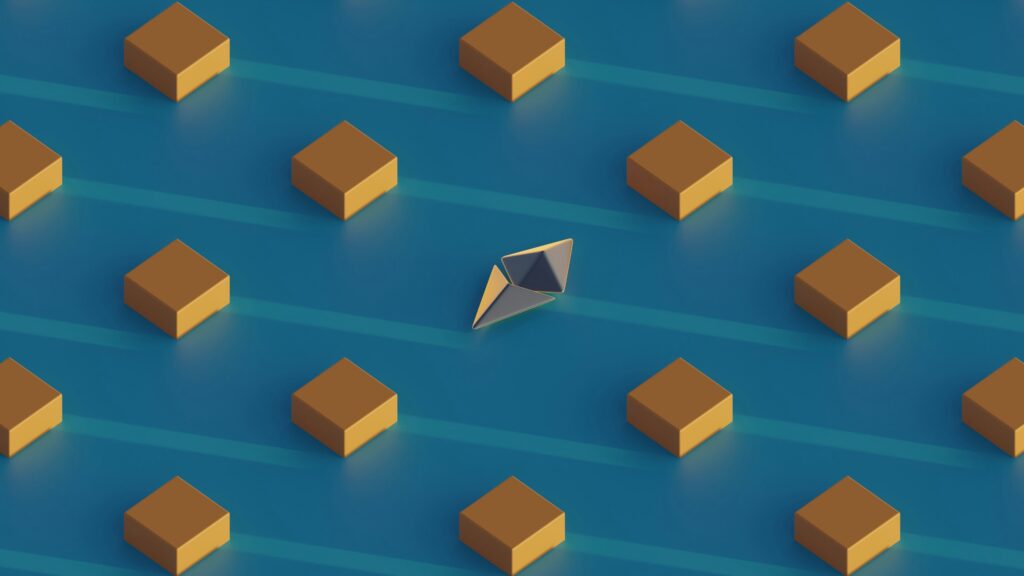

NFTs (Non-Fungible Tokens) represent a revolutionary segment within the digital asset landscape. These unique digital assets have rapidly gained popularity due to their ability to provide verifiable ownership of digital and, sometimes, physical items.

What Are NFTs?

NFTs are cryptographic assets that exist on a blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum which are fungible and can be exchanged on a one-to-one basis, NFTs are unique and cannot be exchanged like-for-like.

They often represent digital art, music, video clips, and virtual real estate. Each NFT contains distinct information making it different from other NFTs, and this uniqueness establishes its value.

- Digital Art: Platforms like OpenSea and Rarible have become popular for trading digital art pieces.

- Music: Musicians use NFTs to sell unique tracks, exclusive albums, or concert tickets.

- Virtual Real Estate: Virtual worlds like Decentraland and The Sandbox allow users to purchase, sell, or lease virtual property as NFTs.

Impact of NFTs on Digital Ownership

NFTs have redefined digital ownership by introducing verifiable and transferable proof of ownership. Before NFTs, owning digital items meant that multiple copies could exist without a central record of ownership.

NFTs authenticate the provenance, or origin, of a digital asset, allowing creators and consumers to trust the authenticity of ownership and transaction history.

- Creator Royalties: NFTs enable automatic royalty payments to creators upon each resale, providing them with a continuous revenue stream.

- Authenticity Verification: Blockchain technology ensures that each NFT and its ownership history are immutable and transparent.

- Marketplaces: Platforms like NBA Top Shot and Foundation have emerged as key NFT marketplaces, facilitating transactions and interactions for digital collectibles.

These attributes have ignited interest and speculation in the NFT market, propelling it into a central conversation in digital finance and investment strategies.

Investment Strategies for Cryptocurrencies

Navigating the crypto market involves various strategies, each with distinct approaches and goals. I’ll delve into key methods to optimize investments.

Long-Term vs Short-Term Investing

Selecting investment duration influences strategy. Long-term (or HODLing) entails holding assets like Bitcoin and Ethereum for extended periods, banking on significant appreciation over years. This method suits investors confident in the digital currency’s future, minimizing the impacts of short-term volatility.

Short-term investing focuses on capitalizing on market fluctuations. Day trading and swing trading involve frequent buying and selling based on hourly or daily price changes. These strategies demand constant monitoring, technical analysis skills, and quick decision-making to profit from short-term price movements.

Risk Management in Crypto Investing

Effective risk management is crucial due to the crypto market’s volatility. Diversification reduces exposure by spreading investments across various coins and tokens.

For example, owning Bitcoin, Ethereum, and smaller altcoins can balance risk and reward.

Setting stop-loss orders limits potential losses. These orders automatically sell a position when the price drops to a specified level, safeguarding against drastic market downturns.

Additionally, leveraging only a small portion of your portfolio for high-risk investments prevents significant losses.

Staying informed about market trends, regulatory changes, and technological advancements helps make data-driven decisions, minimizing unforeseen risks.

Engaging in continuous learning and joining crypto communities provides insights and updates, enhancing risk management strategies.

Navigating NFT Investments

Navigating NFT investments requires a combination of expertise, research, and strategic planning. Knowing how to choose the right NFTs and mitigate risks is essential for success in this emerging market.

Choosing the Right NFTs

Choosing the right NFTs involves evaluating their value, utility, and market potential. Look for NFTs with unique characteristics or affiliations with reputable creators or brands.

Check for rarity, as scarcity often impacts value. Research the creator’s credibility and past projects to gauge reliability and future potential.

- Utility: Choose NFTs that offer additional benefits or functionalities, such as exclusive access to events or content.

- Rarity: Evaluate how unique or limited the NFT is, as rarity can drive demand and value. Examples include limited edition digital art pieces.

- Creator Reputation: Investigate the track record of the NFT creator to ensure their reliability and influence in the market.

- Community and Market: Analyze the community surrounding the NFT, including its market demand and platforms where it’s traded, such as OpenSea or Rarible.

Strategies to Mitigate Risks

Mitigating risks in NFT investments involves diverse strategies. Diversify your portfolio by investing in various types of NFTs, reducing reliance on a single investment. Set a budget for NFT purchases and stick to it, avoiding overspending driven by market hype.

- Diversification: Spread investments across different NFT categories like digital art, collectibles, and virtual real estate, reducing the risk of a single category underperforming.

- Budgeting: Allocate specific portions of funds to NFTs, ensuring you don’t invest more than you can afford to lose.

- Due Diligence: Conduct thorough research on NFTs before investing, verifying authenticity and ownership through blockchain records.

- Market Trends: Stay informed about market trends and developments, using insights to make better investment decisions.

Implementing these strategies enhances the potential for successful NFT investments while minimizing associated risks.

The Future of Investing in Crypto and NFT

Crypto and NFT markets present dynamic opportunities. Understanding future trends helps investors navigate these evolving landscapes.

Predictions and Emerging Trends

Regulatory frameworks and institutional adoption shape future predictions. More institutional investors enter the market, boosting credibility and liquidity. Enhanced regulatory clarity attracts cautious investors.

DeFi integration with traditional finance emerges. Banks, for example, explore partnerships with DeFi platforms, enabling new financial products and services. Crypto-focused financial instruments and insurance options grow.

NFT use cases expand beyond art and collectibles. Industries like real estate and gaming capitalize on NFTs for ownership verification and in-game assets. Brands launch NFT campaigns for marketing and customer engagement.

Sustainability efforts increase. Blockchain networks, such as Ethereum, transition to energy-efficient consensus mechanisms like Proof of Stake (PoS), reducing environmental impact.

Technological advancements drive innovation. Layer 2 solutions and cross-chain interoperability improve transaction speed and reduce costs, enhancing user experience.

Increased mainstream adoption accelerates. Payment processors and retailers, such as PayPal and Shopify, accept cryptocurrencies, encouraging consumer transactions.

Overall, staying informed about regulatory changes, industry adoption, and technological advancements is crucial. This proactive approach aids in making well-informed investment decisions in crypto and NFT markets.